Adjusting amounts for a single rate schedule

Follow these steps to create a new, adjusted rate.

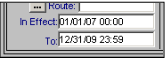

1. Look up the rate to be adjusted. Verify that the proper effective date range has been recorded.

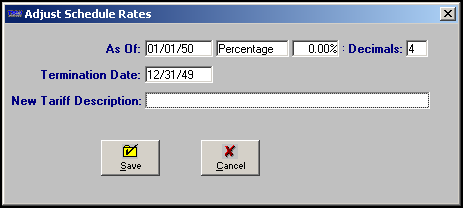

2. Select Edit > Adjust Rates by Factor > This Table. The Adjust Schedule Rates window is displayed.

3. Make entries in these fields:

Field | Definition |

|---|---|

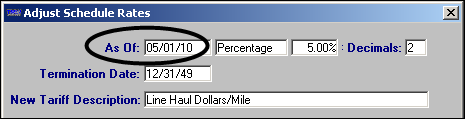

As Of | Date when the adjusted rate is to become effective. The date entered here will be written to the In Effect field in the new rate’s index. Note: When you save the new rate, the system will adjust the original rate’s expiration date (i.e., the value in the To field) when that date is on or after the new rate’s effective date. In such a situation, the expiration date will be changed to the date that immediately precedes the new rate’s effective date. For example, suppose the effective date for the new rate is 05/01/10 as shown in the As Of field in this illustration:  With regard to the old rate, one of the following occurs when the new rate is created: If the original rate expires on or after 05/01/10, the entry in the old rate’s To field will be changed to 04/30/10 so that the original rate does not overlap with the new rate. If the original rate expires before 05/01/10, the entry in the old rate’s To field will not be changed. |

Type of adjustment (no field name is shown) | Select Percentage or Flat Amount. The default is Percentage. |

Adjustment amount (no field name is shown) | Enter the amount by which the rate is to be adjusted. Notes: 1. A percentage must be entered as a decimal. For example, if you are adjusting by five percent, enter .05. 2. If you are decreasing the rate by a negative amount, precede the amount with a minus sign (-). For example, a reduction of one percent would be entered as -.01. |

# Decimals | Enter the number of decimal places the system is to use when rounding new amounts. For example, if you want to limit new amounts to two decimal places, enter 2. The default is 4. |

Termination Date | Date that the new rate will expire. The date entered here will be written to the To field on the new rate’s index. |

New Tariff Description | The free-form comments entered in this field will be written to the Description field of the new rate. |

4. Click Save.

5. A warning message is displayed. Click OK to continue. The system copies the existing rate, assigning a new numeric ID to the copied rate. The new rate is displayed.

6. Make any necessary adjustments to the new rate schedule and save it.