Using maximum pay rates with mileage-based pay

Pay rate maximums can be used with mileage-based pay. However, when working with mileage-based rates keep the following in mind:

By default, when the system calculates mileage-based pay, it creates separate pay details for the mileage between each stop. For instance, if the trip includes two stops, one pay detail is created. If the trip includes three stops, two pay details are created, and so forth.

Rate maximums apply to individual pay details, not to the entire settlement. When the system rates the order, it compares the quantity of each pay detail to the maximum quantity defined for the rate.

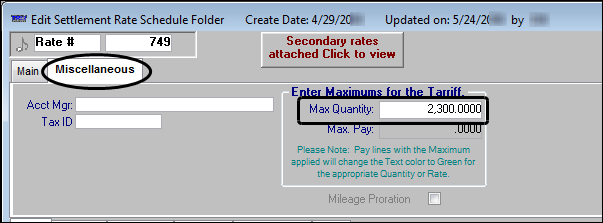

This illustration shows the primary pay rate #749, which is set up for mileage-based pay. Notice that 2,300 is recorded in the Max Quantity field. Because this is a mileage-based rate, the maximum mileage this rate will use is 2,300 miles.

Warning: Mileage-based pay rates having a maximum pay amount are not compatible with standing deductions that are based on the number of miles paid, because:

When the system applies a maximum pay amount rate, it resets the pay detail’s Quantity field to 1.

Standing deductions that are based on the number of miles paid use the quantity in the pay detail’s Quantity field to calculate the standing deduction. This means that the standing deduction would be based on the quantity of 1 instead of the actual miles paid.

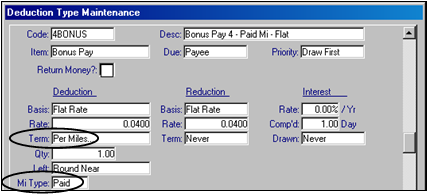

Standing deductions that are based on the number of miles paid have the Per Miles option selected in the Term field and the Paid option selected in the Mi Type field in the Deduction Type Maintenance window.

1.