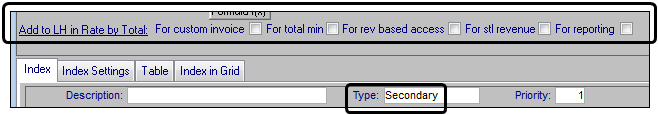

Fields in the Add to LH in Rate by Total section

These fields apply to accessorial rates only. They are visible only when you have selected an option other than Primary in the Type field.

In many cases, the billed line haul charge is independent of the accessorials charged for the same order. However, there are times when you may need to have accessorial charges rolled into the line haul amount for billing or pay purposes. You can set flags on accessorial charge types and/or on accessorial billing rates to have the system do one, some or all of the following:

On a custom hard copy invoice or master bill, roll accessorial charge(s) into the line haul cost so that the customer sees a single dollar amount. However, on the Edit Invoice Folder, list the rolled in accessorial(s) separately from the line haul on the invoice records.

For any billed accessorials that are based on a percent of line haul revenue, multiply the percentage by the sum of the primary line haul amount and all accessorial(s) rolled into the line haul charge.

When the primary billing rate has a minimum charge specified, compare the minimum to the total line haul amount (primary line haul + rolled-in accessorial(s)). Apply the minimum if the total is less than the minimum.

For internal reporting purposes, roll billed accessorial(s) into the line haul charge.

For a primary pay rate that is based on a percent of line haul revenue, multiply the resource’s percentage by the sum of the billed line haul and rolled-in accessorial(s).

Allow for a charge type or billing rate to be configured as both revenue-based and rolled into the line haul for the purpose of calculating other revenue-based charges.

The following field definitions provide a high-level summary of functionality.

For custom invoice | On the printed invoice or master bill, roll the accessorial into the line haul amount. On the Edit Invoice Folder, list the accessorial separately from the line haul. 1. |

For total min | When the system checks to see if a minimum line haul charge needs to be applied, add this accessorial together with the primary line haul charge. If the combined total is under the minimum, apply the minimum charge. Note: The minimum is recorded on the primary rate in the TotLH Min Chg field on the rate header. |

For rev based accessorials | When determining the line haul revenue amount for accessorials that are based on a percent of revenue: 1. Add this accessorial charge to the primary line haul amount. 2. Multiply the sum by the percentage recorded in the revenue-based accessorial rate. |

For stl revenue | To determine the revenue amount for line haul settlement rates that are based on a percent of line haul revenue, add this accessorial charge to the primary line haul amount. Multiply the sum by the percentage specified in the revenue-based line haul pay rate. |

For reporting | For internal reporting purposes, roll the accessorial amount into the line haul charge. Note: This flag can be used when you create your own Access or Excel reports. No base system reports make use of it. |