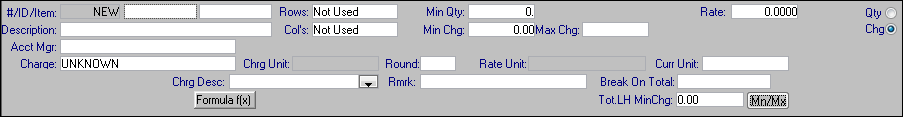

Fields that display by default

When you create a new rate schedule, these fields are shown by default:

The Charge field is the only field that requires entry in the rate header. Your selection of a charge type in that field determines how the system calculates the billing amount when it applies the rate to an order. Make entries in the other fields as needed.

#/ID/Item | There are three fields to the right of this field name: |

# | The first field displays the unique numeric identifier that the system automatically assigns to the rate the first time it is saved. You cannot modify this identifier. |

ID | The second field allows you to assign a user-defined identifier having a maximum of 13 alphanumeric characters. |

Item | The third field allows you to assign a second user-defined identifier having a maximum of 13 alphanumeric characters. |

Description | Enter a free-form description that summarizes the rate’s function. This field displays up to 24 of the 50 alphanumeric characters allowed. |

Acct Mgr | This is a free-form text field that allows for up to 30 alphanumeric characters. Although it was designed for entry of an account manager's name, you can use it as a comment field. If desired, use the Screen Designer feature to rename it. For details, see: Guide: System Administration|Chapter: Customizing window layouts with the Screen Designer feature |

Rows and/or Col's | Use the Rows and/or Col's fields to define rate tables. If you are not setting up a rate table, both of these fields must be set to Not Used. If you are setting up a table, you must make an entry in one or both of these fields. The options shown in the Rows field are the same as those in the Col's field. For definitions of the options, see: Guide: Billing Rate Basics | Chapter: Setting up a rate table |

Ignore zero rates | This field displays only when an option other than Not Used is selected in the Rows and/or the Col’s fields. In some rate tables, a row and column may intersect at a cell for which no rate applies. For example, suppose Illinois is recorded as both an origin state and a destination state in a point-to-point rate schedule. The contract has rates for orders from and to Illinois and other states, but there is no rate for loads that begin and end in Illinois. The system does not accept a null (blank) value in a cell; therefore, you must enter 0.0000 in the Illinois-to-Illinois cell. By default, the system considers zero to be a valid rate and will apply it for orders beginning and ending in Illinois. You can select the Ignore Zero Rates check box to specify that 0.0000 entries are just placeholders and not valid rates. Any zero-dollar rates that exist in the rate table will not be applied. |

Min Qty | If desired, enter a minimum billing quantity. If the actual quantity falls below the minimum quantity specified for the rate, apply the minimum quantity. The quantity is determined by the charge type you have selected. For example, suppose the following is true: The charge type is Freight (Weight), and is based on a billing unit of 100 pounds. The number 500 is entered in the Min Qty field. The load being rated is 350 pounds. The customer will be billed for 500 pounds, even though the actual load was only 350 pounds. |

Min. Chg | If desired, enter a minimum charge. If the calculated charge is less than this minimum amount, the system applies the minimum as a flat rate. |

Rate | Applicable for a rate schedule that has only one rate. Enter the per unit rate. For example, suppose you have chosen Freight (Distance) as the charge type. If you enter $1.50 here, the system will multiply the number of miles by $1.50 per mile. Notes: 1. If you make entries in the Rows and/or Col’s fields, this indicates that multiple rates exist and a table is required. As a result, the Rate field will no longer be visible on the header. 2. Some secondary rates are based on a percentage of line haul revenue. In such cases, enter the percentage as a decimal. For example, if a rate is based on 65% of the revenue billed, enter .65. |

Rating Option | This field displays only when an option other than Not Used is selected in the Rows and/or the Col’s fields. After you have specified how the rows and/or columns in your rate table are defined, you can use the Rating Option drop-down list to select the rating method for your rate schedule. The options are: None The default rating method is to be used, i.e., multiply the quantity by the rate of the row in which the quantity falls. Use Next (use range quantity) Allows you to specify how the system should round up when the charge quantity falls between two rows/columns. For example: Suppose the value in the first row/column is 300 and the value in the second row/column is 400; the billing quantity is 340. Selecting the Row or Column option in the Option Applies To field tells the system to round up the billing quantity according to the quantity in the next row/column. Therefore, the billing quantity will be rounded up to 400. For details, see Quantity-based options that affect how table rates are applied. Incremental Uses more than one rate in a table to compute charges. For example, suppose the following is true: The value in the first row/column is 300. The value in the second row/column is 500. The value in the third row/column is 700. The billing quantity is 630. Selecting the Row or Column option in the Option Applies To field tells the system to break down the billing quantity according to the limits set by the rows/columns. Therefore, the rate will be determined as follows: The first 300 of the billing quantity will be calculated at the rate for 300. The next 200 of the quantity will be calculated at the rate for 500. The last 130 of the quantity will be calculated at the rate for 700. The sum of the three amounts will be the charge on the invoice. For details, see Quantity-based options that affect how table rates are applied. Best Charge (Method A) Determines the minimum charge that can be computed using the rate table for the charge quantity recorded on the order. For example, suppose you have a long-time relationship with a client and need to maintain good will. You bill this client by weight, using a rate table. The rate table contains three ranges: 999 lbs @ .15/lb 1499 lbs @ .10/lb 2000 lbs @ .08/lb. Your client’s order contains 1480 lbs. By selecting the Best Charge option, you tell the system to compute two charges: The billing quantity times the table rate The minimum quantity of the next higher range times the rate at the next higher range. It then should apply the lesser amount. So, instead of billing the client the charges for the exact weight on the order ($148), the system determines that using the minimum quantity of the next range would produce a better rate ($120). Note: The quantity range must be whole numbers to use this option. |

Option Applies To | This field displays only when an option other than Not Used is selected in the Rows and/or the Col’s fields. Your selection in the Option Applies To field specifies how the entry in the Rating Option field is to be applied. The options are: N/A (default) This value applies only when the Rating Option field is set to None. Rows Apply the selected rating method to the rows in the table. Columns Apply the selected rating method to the columns in the table. For details, see Quantity-based options that affect how table rates are applied. |

Chg Qty  | For rate schedules where charge types are based on a quantity (miles, pounds, volume, count, or percent of revenue), you can apply a minimum quantity or flat dollar amount for individual cells. Use one of these radio buttons to specify how the system is to calculate the minimum: Chg (default) Entries represent minimum flat rates. If the calculated charge falls below the minimum dollar amount specified for the cell, apply the minimum charge. Qty Entries represent minimum quantities. If the actual quantity falls below the minimum quantity specified for the cell, apply the minimum quantity. |

Charge | This is a required field. From the drop-down list, select the appropriate charge type for this rate. This selection determines the billing unit on which the rate will be based. For example, suppose you use the charge type is Freight (Weight), which is based on a billing unit of 100 pounds (i.e., per hundredweight). The charge will be calculated like this: (actual freight weight / 100 lbs) x rate Note: The charge types displayed in the drop-down list correspond to the rate type, as shown in the Type field below the rate header.  By default, the Type is set as Primary (Linehaul) when you first access the Edit Billing Rate Schedule Folder. If you are creating a secondary, line item, or linked line item rate, change the entry in the Type field so that accessorial charge types display in the list. |

Chrg Unit | This field is read-only. It displays the unit of measure defined for the charge type. For example, for the charge type Freight (Weight), it displays Weight. |

Unit Round | Applies to rate schedules having charge types that are based on a quantity (miles, pounds, volume, count). It is useful when the order and billing quantities are different units of measure. For example, suppose a billing contract requires billing by tons, but the quantity was entered as pounds on an order. During the rating process, the system converts pounds to tons. Frequently a unit conversion results in a fractional billing quantity, which is shown in decimal form. Enter the desired number of decimal places (0 – 6) in the Unit Round field. For decimals ending in a number that is 5 or higher, the system rounds up. For decimals ending in a number that is 4 or less, it rounds down. Note: By default, the field is blank, i.e., has a null value. If you do not make an entry, the system rounds to four decimal places. |

Rate Unit | This field is read-only. It displays the rate per unit quantity defined for the charge type. For example, for the charge type Freight (Weight), it displays $/100 lbs. |

Curr Unit | This field displays the currency specified for the charge type. If no currency was specified for the charge type, this field is blank; select the currency that applies for the rate. |

Chrg Desc | This field allows you to enter a free-form commodity description that will override the usual commodity description on the body of a printed invoice. This is useful when you have one name for a commodity, but a customer has another. Notes: 1. To record the alternate description, select Optional templates below and override the words with free-form text. 2. The override description applies only to the first commodity on the trip. 3. The override is shown in the detail area of the invoice. If the invoice format you use shows the commodity description in the invoice header, the description in the header will be printed as it is entered in your commodity master file. |

Rmrk | Free-form text regarding the rate schedule. The field displays 35 characters; it allows entry of up to 254 characters. To see the entire field, right-click on the field and select Zoom from the shortcut menu. Notes: 1. If an entry was made in the Remarks field for the charge type used on the rate, that remark displays here automatically. 2. When an order is pre-rated in Order Entry or Dispatch, the system copies an entry in this field to the Rmrk field in the order header. If a remark already exists on the header, the system appends the remark from the rate to the pre-existing remark. 3. When the Compute feature is used in Invoicing, the remark on a primary rate is copied to the Remarks field in the invoice header. Many invoice formats are configured to print the remark. This is useful when you want to communicate a special condition regarding the rate applied. For example, if the rate scheduled involves flat rates that include a tarping charge, you may want to record the remark: “Rate includes tarping charge.” 4. When the Compute feature is used in Invoicing, the remark on an accessorial rate is copied to the Notes area in the invoice detail for that accessorial. The Notes indicator, shown above and slightly to the right of the charge quantity, turns red when a remark exists.  To see the remark, click on the Notes indicator. |

Break on Total | This field is visible only when you select Primary in the Type field: it applies only for Rate by Detail orders. Such orders may have the same commodity recorded for multiple freight details. You can set up commodity-based rates that will allow a break on freight charges by combining the total charge quantities on all freight details for the same commodity or commodity class. The Break on Total field allows you to specify whether the break is based on Commodity Code or Freight Class. |

TotLH MinChg | Applies to primary rates only. You can use it to specify a minimum flat rate that applies when accessorial charges have been rolled into the line haul amount. The system adds the line haul charge to the amounts for any accessorials marked For tot min that apply for the order. If the total is less than the minimum in the TotLH MinChg field, the system applies the minimum as a flat rate. |