Retrieve payroll data and generate reports

These forms are available in Payroll and Returns Generator:

-

American payroll reports

-

940/941

-

1095-C

-

1099

-

W-2

-

-

Canadian payroll reports

-

T4

-

T4A

-

RL-1

-

American payroll reports

| TruckMate can generate payroll reports for W-2, 1099, and 1095-C formats, but it does not store historical versions of the report data. It also does not support submitting amended versions for these formats. |

Generate W-2s

-

Choose W2 from the Select Form drop-down list. The Employee and Company grids display W-2 headings.

W-2 Record Codes and Order of Generation:

CODE REQUIRED SUPPORTED BY TMW RA - Submitter Record

Yes

Yes

RE - Employer Record

Yes

Yes

RW - Employee Wage Record

Yes

Yes

RO - Employee Wage Record Optional

Optional

Yes

RS - State Wage Record

Optional

For: KY, WI, MO

RT - Total Record

Yes

Yes

RU - Total Record

Optional

Yes

RV - State Total

Optional

Yes

RF - Final Record

Yes

Yes

-

All records are 512 characters long.

-

RO is required if any of the fields for an EE in RO record is not 0 or blank. Do not create it if all fields are zero or blanks.

-

TruckMate currently supports RS records only for Kentucky (KY), Wisconsin (WI), and Missouri (MO). RS records should follow RW or optional RO record. If multiple State Wage records for an EE, include all of the RS records for the EE immediately following the related RW or RO records. Do not generate RS if only blanks would be entered after the record identifier.

-

RT must be generated for each RE.

-

RU is required if RO is prepared. Do not generate RU if only zeros would be entered in all positions.

-

RF must be the last record in the file. Nothing after the RF record is allowed in the file.

-

-

Select Retrieve. The Search Preferences window opens.

-

Choose a Company ID to report on.

-

Select the calendar icons to select start and end dates from the calendar presented. You can also right-click the date box and select a specific day, week, or month.

This sets the Date Range for the Payroll records you need to generate. The Select Date Range field (calendar control) is the same as used in other TruckMate programs.

-

Select OK. Your W-2 data is saved to the database and displayed on the grid in the main window.

You can now print a report or submit this information electronically (create a magnetic media file).

|

Generate 1099s

| Make sure you have run your Driver Pay, Driver Deductions, and Check Registers for the processing year before running the 1099 Wizard. |

-

Select 1099 from the Select Form drop-down list and select Retrieve. The first page of the 1099 Wizard is displayed.

It provides step-by-step instructions for setting up your 1099 Forms. See Using the 1099 Wizard for details. For more information about how 1099s are calculated in TruckMate, see Additional Taxation Information.

Warning: TruckMate does not support multi-company 1099 forms unless the company is set up to use a Multi-Schema database.

-

Once you have finished navigating through the wizard, select OK to save your data and return to the main window. You can now print a report or submit this information electronically (create a magnetic media file).

Notes:

-

When preparing 1099 data for magnetic media filing, save it as a ".csv" file type. If you do not, it will not function correctly in Payroll and Returns Generator.

-

TruckMate does not store historical versions of the 1099 report data and does not support submitting amended versions for this format.

-

Generate 940s and 941s

-

Select 940/941 from the Select Form drop-down list.

-

Select Retrieve. The Employer’s Federal Unemployment return form opens.

-

Verify your Company Code in the Select a Company pane.

Company Codes are configured in Company Profiles.

-

Select either Form 940 (Annually) or Form 941 (Quarterly).

-

Select Next. Either form 940 or form 941 opens.

Generate 940s

To complete the Form 940 (Annually), follow these steps:

-

Select a year from the Select Year dropdown menu.

-

Use the Yes or No radio buttons to answer the questions in the A, B and C sections.

If your answer to the question in section A is No, you can skip the other two sections.

-

Select Next. The Step 2 window opens.

Step 2 is for the computation of taxable wages.

-

Select Calculate. The system builds a list of employees that received earnings in the requested pay period (the year you selected in Step 1). It then calculates all the totals.

Depending on the size of your database, this may take a few seconds.

-

Select Next when the calculations are complete (100% of the progress bar). The Tax Due or Refund window opens.

This section allows you to obtain the taxable payroll information and populate this data into the correct lines on the 940 form.

-

Select the Get Taxable Payroll button. The system looks at all the employee records in the database. It then populates the screen with the correct data from your database.

The importance of having well-maintained data in Payroll Setup is crucial here. If no values were entered, we would not get any taxable payroll.

-

Check amount displayed in the Total FUTA tax deposited for the year field.

There is no way for TruckMate to know if a company actually made those payments. Therefore, the system will retrieve the FUTA amount found in the CHECK_MSTR TruckMate table.

-

If the amount matches the amount actually paid, no further action is required. If the amounts do not match, you can overwrite the original amount in box 8 with the amount that was paid and select the Enter key. The value is recalculated using the newly entered amount.

-

-

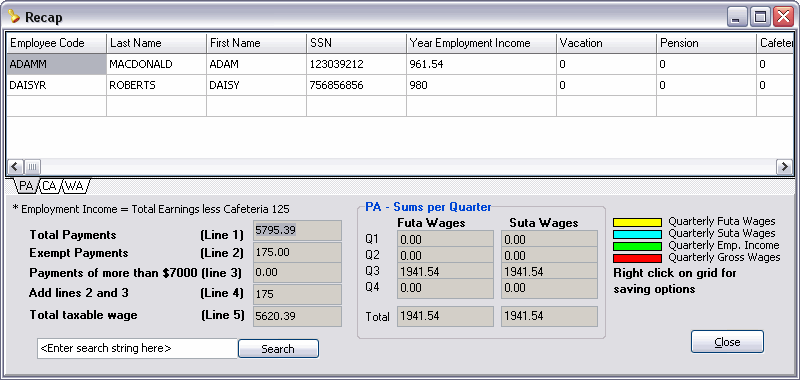

Optional: Select Show Recap Summary to pull the quarterly information for your employee records.

-

The Recap Summary window displays employee information broken down into separate state tabs. You can view employee data for different states by selecting a tab from just beneath the data grid.

-

The information on this grid is color-coded. Refer to the legend on the lower right side of the window for details.

-

Right-click the data grid on any state tab to access several options for saving the displayed data.

-

-

Select Close when you have saved your quarterly information.

-

Select Next. The final window opens (Step 4 of 4) and shows your "Balance Due".

-

Select Save to save the 940 information.

Note: TruckMate does not provide a "Standard Report" for 940 forms, but "Custom Reports" can be made available upon request.

-

If you have previously added a Custom 940 Report to your TruckMate Reports list, select the Report button to access and run it.

-

Once done, select Close to complete this process.

-

When you reach the final step and receive a message saying you have successfully completed your form, select Save to save your data to the database.

-

Select Close to return to the main window.

You can now print a report or submit this information electronically (create a magnetic media file)

Generate 941s

To complete the Form 941 (Quarterly), follow these steps:

-

Select a year from the Select Year dropdown menu.

-

In the Select Period pane, select the time period you want to gather records for by selecting its radio option.

If you do not have to file returns in the future, enable the associated flag and enter the Date that the final wages were paid.

-

Select Next. A list of questions opens.

Note that this window looks very similar to the 941 form, with 17 lines showing detailed information pulled from the employee record.

-

To obtain the information from the TruckMate database, select Calculate at the bottom of the screen.

Depending on the size of your database, the system will take a few seconds to generate all of the information.

-

Optional: After selecting Calculate, you can select See Recap to view the Employee records gathered for the period you selected in Step 1.

On the window that appears, you have several means of saving the employee data that is displayed in the grid. Refer to the Employee(s) Year-to-Date Information grid for an explanation of the options available for saving the data.

-

Browse through all five sections of the form and confirm that the data generated is correct. You may adjust values as necessary throughout the form.

-

Once all the fields contain values, select Next.

-

Optional: If you selected the You were a semiweekly schedule depositor for any part of this quarter checkbox in Part 2 of the 941 form, you must fill out the Schedule B - Employer’s Record of Federal Tax Liability form:

-

Select the semiweekly scheduled depositors checkbox to enable the Calculate button.

-

Select Calculate to generate your semiweekly figures.

-

Select Next.

-

-

The final window opens and displays your "Balance Owing".

You can report and save the data you have compiled:

-

Select Save to save your 941 information. If you have already saved a return into your database, you will receive a warning message.

-

If you received a warning message, select OK.

-

To pull up the 941 report, select Report. The Report Selection window opens.

-

Select US_941.rpt from the Reports grid.

-

Select OK.

This report will generate the detailed information from the tax return, and allow you to print out the form using your printer on the actual 941 form. When you view the report on your screen, note that there are no lines or additional information on this page. This is because this page is meant to be printed on the actual 941 form.

In this instance, place the blank 941 form into your printer and select Print at the top of the screen.

-

Optional: If you completed Step 8 to gather semiweekly deposit information, you can now select Print Schedule B. The Report Selection window will appear. Select the US_941_SchedB.rpt file.

The Schedule B report will then be generated, and you can select Print on the Report Preview window to print the Schedule B report.

-

-

Back on the final window of the 941 Wizard, select the Close button to complete the 941 tax form process.

-

When you reach the final step and receive a message saying you have successfully completed your form, select Save to save your data to the database.

-

Select Close to return to the main window.

You can now print a report or submit this information electronically (create a magnetic media file).

Canadian payroll reports

Generate T4s

Before creating a T4, make sure that you are on a recent TruckMate release. This makes sure the system uses current payroll data. The patch with payroll changes generally releases mid-December. Last-minute changes from Canada Revenue Agency may change this timing.

Note: The values shown in any illustrations are examples only. Make sure to check your own values for accuracy. Do not copy the exact values in the illustrations.

-

Open Payroll and Returns Generator.

-

In the Select Form dropdown menu, select T4.

-

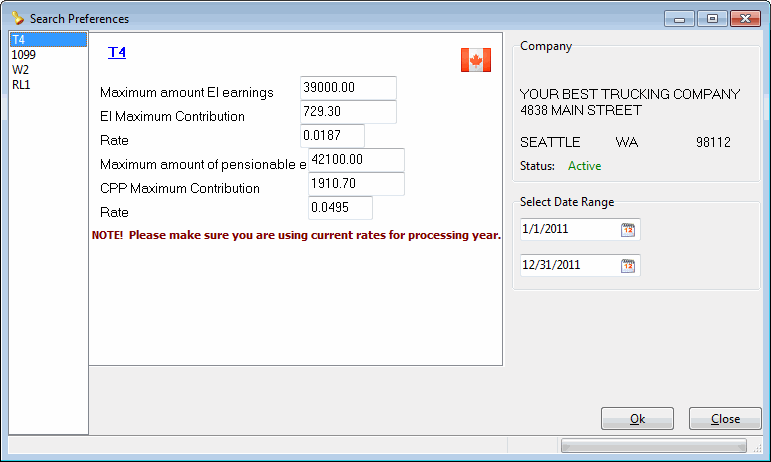

Select Retrieve. The Search Preferences window opens.

-

Confirm these values are accurate for the current year and update them as needed:

-

Maximum amount EI earnings

-

EI Maximum Contribution

-

EI Rate

-

Maximum amount of pensionable earnings

-

CPP Maximum Contribution

-

CPP Rate

-

-

Select a date range.

-

Select Retrieve. A confirmation window opens that asks, “Do you want to save the results now?”

-

Select Yes. Your T4 data is saved to the database and displayed on the grid.

-

Select Close. The Search Preferences window closes.

You can now print a report or submit this information electronically (create a magnetic media file).

Generate and submit RL-1 forms

Before creating an RL-1 form, make sure that you are on a recent TruckMate release. This makes sure the system uses current payroll data. The patch with payroll changes generally releases mid-December. Last-minute changes from Revenu Québec may change this timing.

If you notice errors in the file after submitting the form, contact the Division de l’acquisition des données électroniques:

-

Email: [email protected]

-

Phone: 1 866 814-8392

For any other questions about filing your RL slips, contact Revenu Québec at either of these numbers:

-

418 659-4692

-

1 800 567-4692 (toll-free)

Always keep a copy of the acknowledgement of receipt for your files.

Note: The values shown in the illustrations are examples only. Make sure to check your own values for accuracy. Do not copy the exact values in the illustrations.

Generate an RL-1

-

Open Payroll and Returns Generator.

-

In the Select Form dropdown menu, select RL1.

-

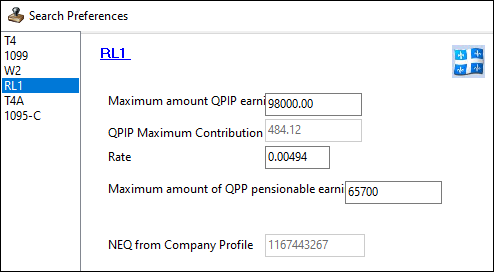

Select Retrieve. The Search Preferences window opens.

-

Confirm these values are accurate for the current year. Update them as needed:

-

Maximum amount QPIP earnings

-

QPIP Maximum Contribution Rate

-

Maximum amount of QPP pensionable earnings NEQ from Company Profile

Revenu Québec publishes updated values in the Formulas to Calculate Source Deductions and Contributions guide. Trimble also publishes a Canadian Payroll Update guide each December to the Learning Center.

-

-

Select a date range.

-

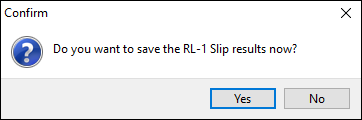

Select Retrieve. A confirmation window opens that asks, “Do you want to save the RL-1 Slip results now?”

-

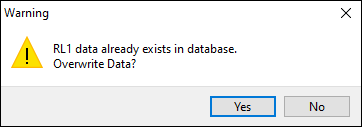

Select Yes. If RL1 data already exists, a warning message opens that asks, “RL1 data already exists in database. Overwrite Data?”

-

Select Yes. The record is saved to the database.

-

Select Close. The Search Preferences window closes.

Validate the RL-1 data

There are two reports you can use to validate the RL-1 values.

-

Payroll Data CDN

-

Payroll Summary

Both of these reports are available in your general TruckMate reports folder.

Run Payroll Data CDN

Payroll Data shows you each of the employee’s individual checks and their totals.

-

Select

Print. The Report Selection window opens.

Print. The Report Selection window opens. -

Select Payroll Data CDN.rpt.

-

Select View. The Enter Parameter Values window opens.

-

Enter either a date range or employee code range.

-

Select OK. The report opens.

Run Payroll Summary

Payroll Summary shows you the total of all payroll codes attached to the employee.

-

Select

Print. The Report Selection window opens.

Print. The Report Selection window opens. -

Select Payroll_Summary.rpt.

-

Select View. The Enter Parameter Values window opens.

-

Enter search parameters:

-

Start Date

-

End Date

-

Pay Code

-

Employee

-

Department

-

-

Select OK. The report opens.

Print the RL-1

After you have confirmed the RL-1 information is correct, you can print the report.

Add the current year’s RL-1 report

If you are on a current TruckMate version, the current year’s RL-1 report is included in a current year folder. You can add the report from that folder to your report selection grid.

-

Select

Print. The Report Selection window opens.

Print. The Report Selection window opens. -

Select

Add. An empty row is added to the report grid.

Add. An empty row is added to the report grid. -

Double-click in the Path field in the empty row. File Explorer opens.

-

Double-click the folder for the current year. The folder opens.

-

Select the CAD_RL1_20xx.rpt file.

-

Select Open.

-

Select

Post. The report is saved to the report grid.

Post. The report is saved to the report grid.

Print the report

After you have added the current year’s RL-1 report you can print it.

-

Select

Print. The Report Selection window opens.

Print. The Report Selection window opens. -

Select CAD_RL1_20xx.rpt.

-

Select View. A preview of the report opens.

-

Select

Print Report.

Print Report.

We recommend that you save the report as a PDF and keep it for your records.

Create a magnetic media file

After you have run and validated the data for the RL-1, you can create a magnetic media file to upload to Revenu Québec.

-

Select

Create magnetic media file. The Magnetic Media window opens.

Create magnetic media file. The Magnetic Media window opens. -

Confirm the Transmitter # Assigned by RQ field has a value.

This number is assigned to you by Revenu Québec. It always starts with NP and has six digits.

-

Select an option from the Transmission Type dropdown list:

-

Original

Select this option for original data records being filed. You can select the This is a Test RL-1 transmission checkbox to create a test file and submit it to Revenu Québec. -

Amended

If you have generated an RL-1 form and then realize you need to amend it, you can make the correction in Employee Profile. You can then return to Payroll and Returns Generator to retrieve your original data again. -

Cancelled

You can cancel an Original or Amended record only. You cannot cancel an already cancelled RL-1 record since cancelled records are deleted from Revenu Québec’s system immediately.

-

-

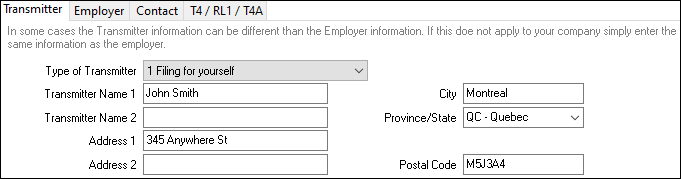

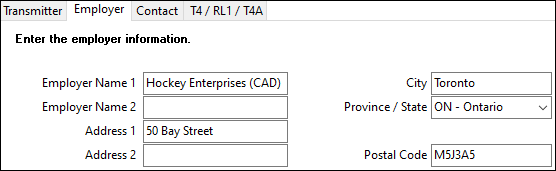

Confirm that the information on each tab is correct:

-

Transmitter

Specify if you are filing on behalf of employees, other filers, or for yourself and other filers.

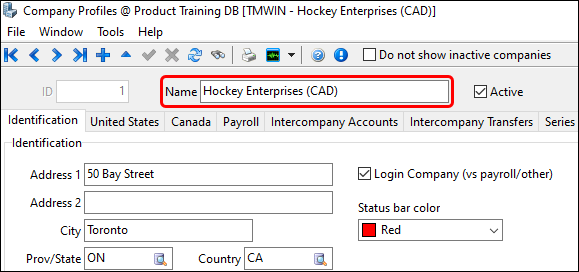

-

Employer

The Employer Name must be an exact match to the company’s Name in Company Profiles:

-

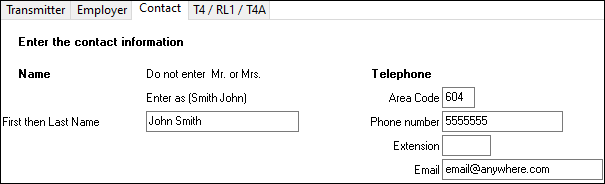

Contact

Enter your contact information.

-

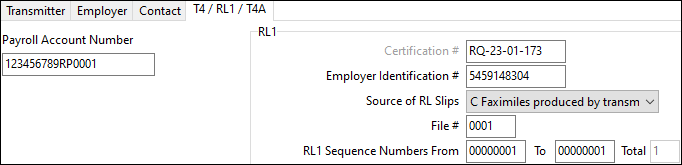

T4/RL1/T4A

-

Certification #

This field is populated automatically with TruckMate’s certification number. TruckMate must be certified for RL-1 slips each year, and this field is always populated with the current year’s number. -

Employer Identification #

Enter your employer identification number assigned to you by Revenu Québec. -

Source of RL Slips

This option is automatically set to C Faximiles produced by transmitter. -

File #

Enter your file number provided by Revenu Québec. -

RL1 Sequence Numbers From/To

Enter the RL-1 sequence numbers provided to you by Revenu Québec.

-

-

-

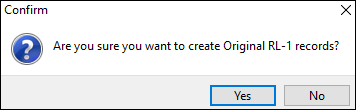

Select Next. A confirmation message opens that asks, “Are you sure you want to create Original RL-1 records?”

-

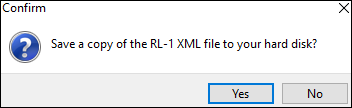

Select Yes. A confirmation message opens that asks, “Save a copy of the RL - 1 XML file to your hard disk?”

-

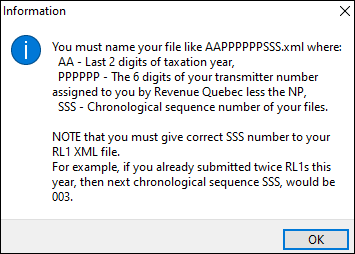

Select Yes. A window opens with a description of how to name the RL-1 file.

-

Select OK. The window closes and File Explorer opens.

-

Enter a file name with the correct format:

Here is an example of a correctly formatted file name: 24123456001.xml.

-

Last 2 digits of taxation year: 24.

In this example, the RL-1 is being filed in 2024.

-

The 6 digits of the transmitter number assigned by Revenu Québec: 123456.

In this example, the transmitter number is NP123456, but you do not include the letters “NP” in the file name.

-

Chronological sequence number of your files: 001

If you filed another RL-1 in 2024, its sequence number would be 002, the next number 003, and so on.

-

-

Select Save. The XML file is saved to your device.

Note: If you choose not to save your file, the information is deleted from the records table.

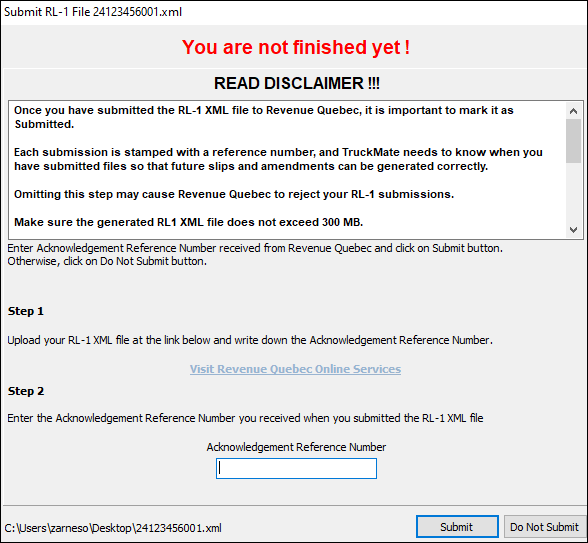

The Submit window opens.

-

Follow Step 1 in the Submit window to upload your RL-1 XML file to Revenu Québec. Take note of the maximum file size when uploading the XML file.

After they have processed your file, Revenu Québec will send you an Acknowledgement Reference Number.

-

Enter your Acknowledgement Reference Number.

-

Select Submit. A confirmation window opens.

Note: If you select Do Not Submit, your XML file is still created but the filename is changed to label it as Unsubmitted. The file cannot be submitted to Revenu Québec.

-

Select OK. The upload process completes.