Setting up an Additional Earnings pay rate

You can set up an Additional Earnings pay rate to calculate holiday pay automatically for your drivers. The system creates the holiday pay details during the Collect process in Final Settlements. Setting up holiday pay as Additional Earnings is most helpful when you want to create holiday pay for all your drivers. When a holiday falls within a pay period, the system creates Additional Earnings holiday pay for all drivers that meet the index key restrictions set on the rate. It does not matter whether the driver worked on the holiday.

To use the feature, you set up:

-

A calendar specifying the days eligible for holiday pay

Note: Before creating your Additional Earnings rates for holidays, you must set up a holiday schedule specifying the days eligible for holiday pay.

-

A pay type with a Unit Basis of Pay Day Off

-

Additional Earning pay rates using the Holiday Group rate table option

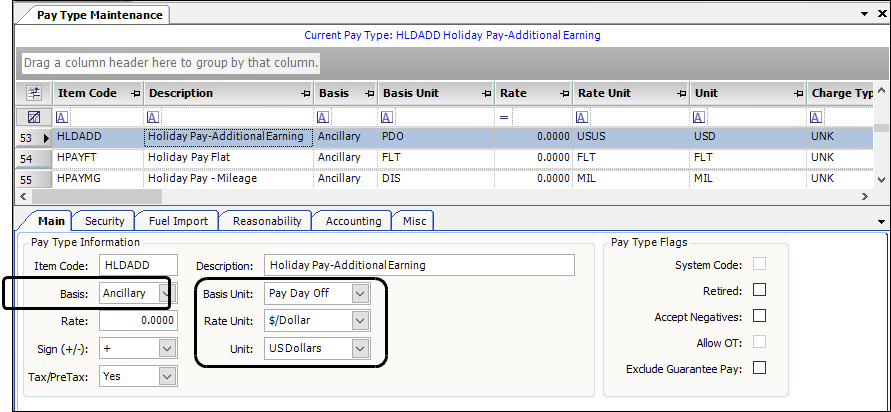

This illustration shows how you could set up a pay type for an Additional Earnings rate.

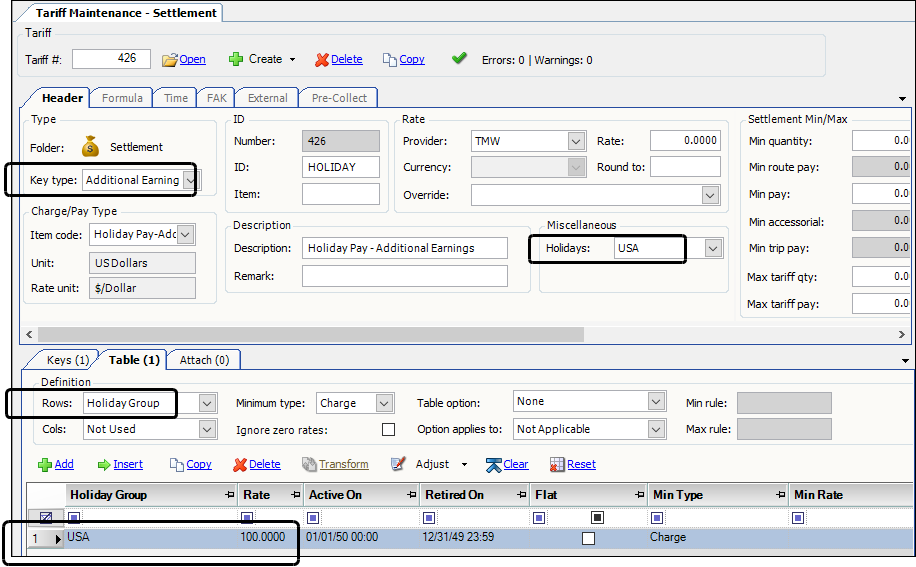

This illustration shows how you could set up an Additional Earnings rate based on the sample pay type. This rate calculates pay when a holiday occurs within a pay period. Notice that:

-

The holiday schedule is specified in the Holidays field.

-

The rate table’s rows are defined by Holiday Group.

-

This rate is setup to pay $100 to every driver on the specified holidays.

Note: You could use index key restrictions to limit the pay to a certain group of drivers based on Driver Type, Driver Terminal, or other restriction.

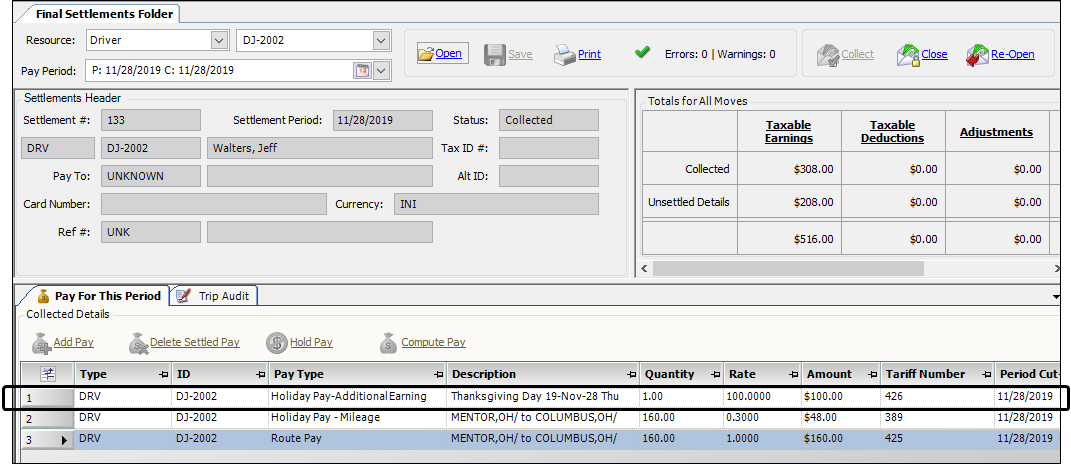

This illustration shows the Additional Earnings holiday pay rate #426 applied to Driver DJ-2002 pay record in Final Settlements.