Setting up a pay type for a recurring adjustment

A pay type, also known as a settlement type, is any of the following:

-

An item that is considered a taxable earning

-

A reimbursement

-

An item that may be deducted from a resource’s pay

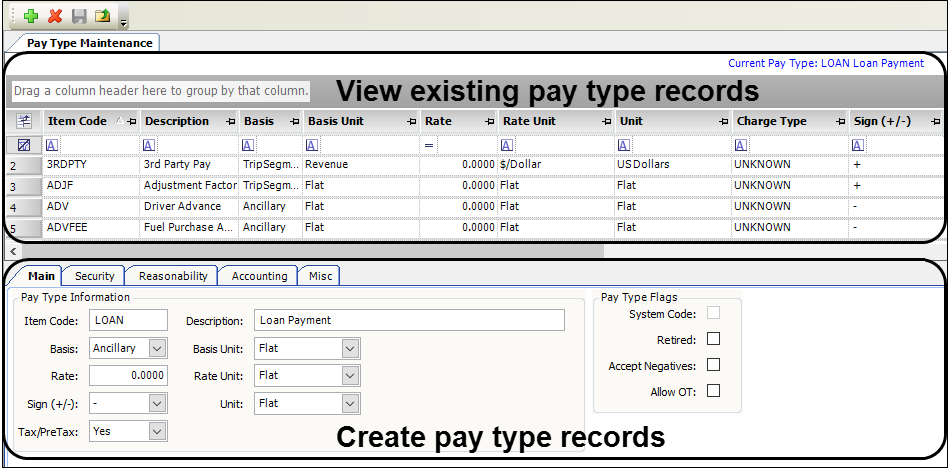

You set up a pay type in the Pay Type Maintenance window. To access the window, go to Tools > Setup > Pay Type Maintenance.

-

The top of the window displays existing pay type records.

-

You use the tabs at the bottom of the window to create new records.

| You must set up a pay type before you can set up a recurring adjustment record. |

Creating a pay type for a recurring adjustment

A recurring adjustment is a scheduled adjustment record that you assign to a specific resource. Each recurring adjustment is based on a pay type. Use the tabs in the Pay Type Maintenance window to set up a pay type for a recurring adjustment.

Follow these steps.

-

Go to Tools > Setup > Pay Type Maintenance.

The Pay Type Maintenance window opens. -

To create a pay type, click Add.

A new row is added to the grid. -

In the fields, enter the appropriate information.

-

To save the pay type, click Save.

Main tab

Required field: *

| Field | Definition |

|---|---|

Item Code * |

Enter a unique ID (up to six characters) for the pay type. |

Description * |

Enter a description of the pay type. This text prints on the settlement sheet. |

Basis * |

Select Ancillary. |

Basis Unit * Rate Unit * Unit * |

Select Flat in each field. Note: You do not use these fields to determine the pay calculation method. Instead, you define the calculation method when you set up the recurring adjustment based on this pay type. |

Rate |

This field does not require an entry for a recurring adjustment. |

Sign (+/-) |

Indicate whether this is a positive pay type or a negative pay type. Do one of the following:

|

Tax/PreTax |

Indicate whether the recurring adjustment is taxable. Use this chart to determine which selection to make in the Tax/PreTax field.

|

Security tab

| Field | Definition |

|---|---|

Edit in Dispatch |

TMW recommends that you clear the Edit in Dispatch check box. This prevents dispatchers from being able to look up, add, or delete deduction pay details in the Advances/Misc Labor window. |

Accounting tab

Required field: *

| Field | Definition |

|---|---|

AP GL# |

If the pay type is used with settlements for Accounts payable resources, enter the pay type’s default general ledger number. |

Payroll GL# |

If the pay type is used with settlements for Payroll resources, enter the pay type’s default general ledger number. |

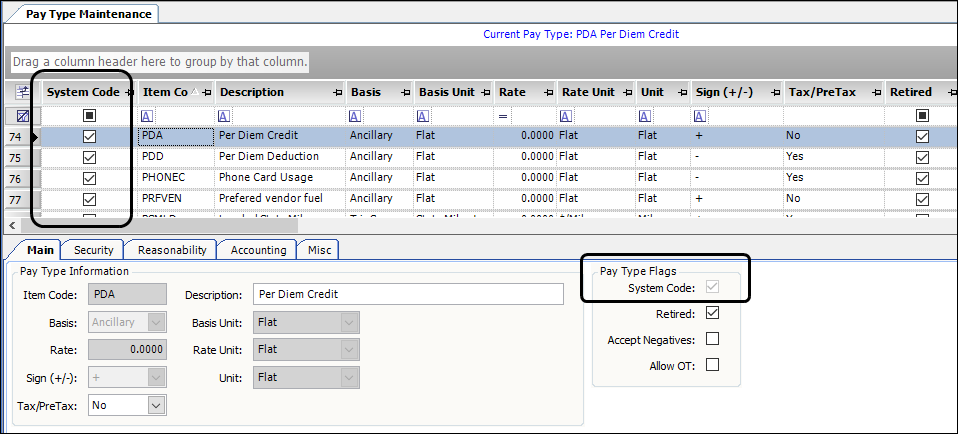

System code pay types used with recurring adjustments

Pay types that are a standard part of TMW Back Office are pre-loaded in the system. These pay types are called system codes and cannot be deleted. You can retire system codes if you prefer not to use them.

An example of a pay type system code is shown in the following illustration. System code indicators display in the grid and in the Pay Type Flags section of the Main tab.

The following system codes for deduction pay types are intended for use with the recurring adjustment feature.

| Item Code | Description | Used for |

|---|---|---|

ESC |

Escrow Payment |

Setting up standing deductions for escrow accounts |

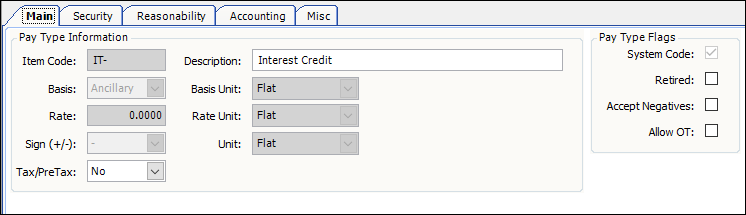

IT- |

Interest Credit |

Interest paid on money held by a trucking company into an account for an asset |

IT+ |

Interest Payment |

Interest credited on money held by a trucking company in an account for an asset |

PDA |

Per Diem Credit |

Issuing non-taxable per diem pay Note: Due to special coding used for this pay type, do not use it when manually entering per diem amounts. Instead, set up a separate per diem pay type to be used for manual entries. |