Per diem adjustments

Per diem pay is a dollar amount granted to company resources to reimburse them for work-related expenses (such as meals) incurred while on the road. A per diem adjustment can be based on a flat rate or percentage of pay. A trucking company may include per diem as part of a driver’s compensation package.

The most common method of calculating a per diem adjustment is based on the number of miles driven for trips for which line haul pay is issued during a pay period.

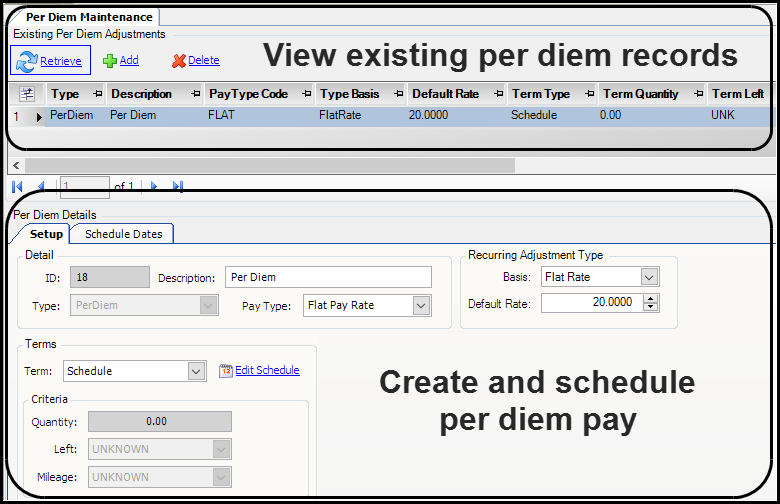

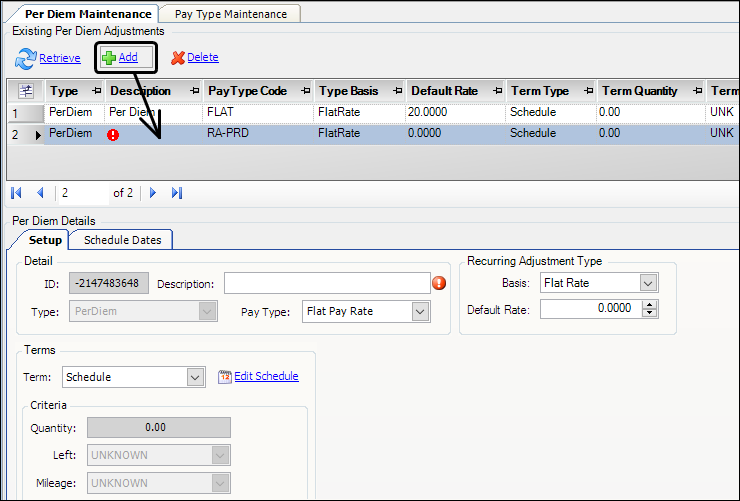

You set up per diem adjustments in the Per Diem Maintenance window. To access the window, go to Tools > Setup > Recurring Adjustments > Per Diem Maintenance.

In the Existing Per Diem Adjustments section at the top of the window, click Retrieve to view existing per diem adjustments.

You create new adjustments in the Per Diem Details section at the bottom of the window.

| After you set up a per diem adjustment, you assign it to the appropriate assets. For details, see Assigning a per diem adjustment to a resource. |

How the Per Diem Credit pay type works

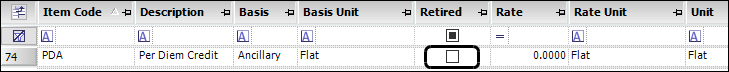

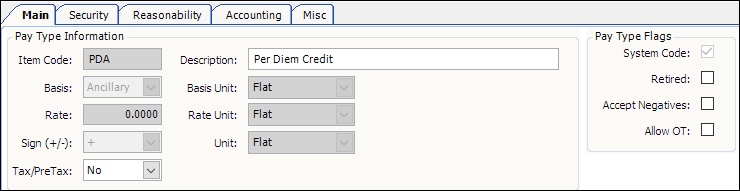

The Per Diem Credit pay type has been set up as a system code. Because this pay type already exists, you do not have to create any other per diem-related pay types.

The Sign (+/-) field shows that the per diem amount is added to the resource’s pay.

The Tax/PreTax field shows that this pay is not taxed.

|

If the Per Diem Credit pay type is retired, you must activate it. The system does not allow you to manually clear the Retired check box in the Pay Type Flags section of the Main tab. You must use a SQL statement. Contact Support for more information.

|

Basing per diem pay on the number of miles driven

To automate the per diem payment process, you can set up a per diem adjustment that is based on the number of miles driven during a pay period. You assign a flat amount to be paid for every so many miles traveled.

For mileage-based per diem pay, the system uses mileage for any trips for which line haul pay was issued during the pay period. To identify line haul pay, it reviews the pay types used for pay details released to the pay period. A pay detail is considered to be line haul pay if the Basis field for the pay type is set to TripSegment.

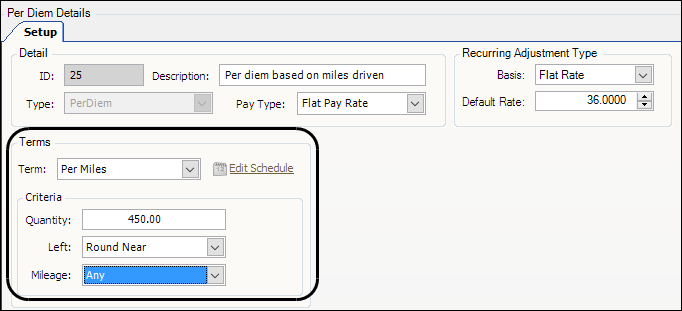

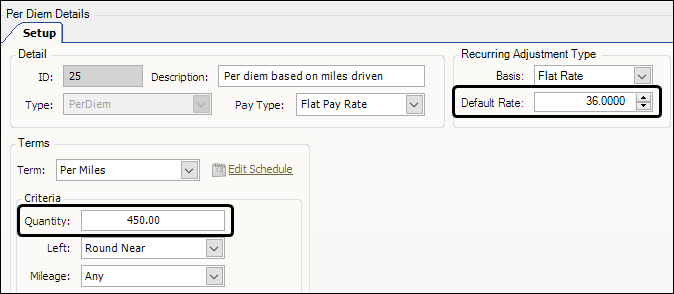

The illustration below shows how the fields might be completed based on the number of miles traveled. In this example, the per diem adjustment is set up to pay the driver $36 for every 450 miles driven.

Creating a mileage-based per diem adjustment

To set up a mileage-based per diem adjustment, follow these steps:

-

Go to Tools > Setup > Recurring Adjustments > Per Diem Maintenance.

The Per Diem Maintenance window opens. -

Click Retrieve to view existing adjustments.

-

Click Add at the top of the window.

A blank record is added.

-

In the Per Diem Details section, make entries for the per diem adjustment.

Required field: *

Field Definition Detail section

ID

System-assigned numeric ID for the per diem adjustment, created when you save the new record

Description *

Enter a brief description of the per diem adjustment.

Type

Read-only field; defaults to PerDiem

Pay Type

Select the Per Diem Credit (PDA) pay type.

Recurring Adjustment Type section

Basis

Select an option.

-

Select Flat Rate to apply the same flat dollar amount each time pay is processed.

-

Select % Pay to apply a specific percentage of pay each time pay is processed.

Default Rate

To apply a default rate for all resources, enter a specific dollar amount.

Note: You can edit the amount on a resource-by-resource basis when you assign the per diem adjustment.

Terms section

Term

Select Per Miles.

The per diem adjustment will apply to trips for which an asset received pay based on the number of miles driven.

Note: Selecting this option activates the Quantity, Left, and Mileage fields in the Criteria section.

Criteria section

Quantity

The default is 1.00.

Enter a different quantity to apply pay based on a specific number of miles, trip segments, or line haul revenue.

For example, you could enter 450 to represent the average number of miles traveled in one day. The per diem pay rate would be applied for every 450 miles driven.

For details about how per diem pay is calculated, see How a mileage-based per diem adjustment is applied.

Left *

Applies rounding when Quantity is a number other than 1.

Select the rounding method used when the number of miles, trip segments, or line haul revenue dollars is not evenly divisible by the Quantity number.

-

Round Near

Round the number up or down to the nearest whole number. -

Round Up

Round the number up to the next whole number. -

Round Down

Round the number down to the preceding whole number.

For example, if Quantity is 3 and the number of miles is 400, the result is 133.333.

-

If you select Round Near, the number rounds down to 133.

-

If you select Round Up, the number rounds up to 134.

-

If you select Round Down, the number rounds down to 133.

Mileage *

Identifies which type of miles is counted when a mileage-based per diem adjustment is calculated. Options are:

-

Any

Use both loaded and empty miles to calculate the amount.Note: This includes all miles driven, even if line haul pay for one or more trips is not based on miles.

-

Empty

Use only empty miles.Note: This includes all empty miles driven, even if line haul pay for one or more trips is not based on miles.

-

Loaded

Use only loaded miles.Note: This includes all loaded miles driven, even if line haul pay for one or more trips is not based on miles.

-

Hub

Count hub miles.Note: This includes all hub miles driven, even if line haul pay for one or more trips is not based on hub miles.

-

Paid

Count only those miles for which mileage-based line haul pay was issued during the pay period.Note: The system totals all miles used to create mileage-based line haul pay, even if that total is different from the actual miles driven.

-

-

Click

Save.

Save.

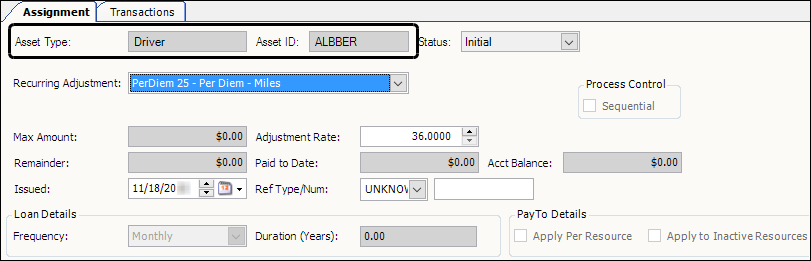

Assigning a per diem adjustment to a resource

If a resource (for example, a company driver) is to receive per diem pay, you must assign the correct per diem adjustment.

-

Go to Tools > Setup > Recurring Adjustments > Recurring Adjustment Assign Asset.

The Assign Asset window opens. -

In the Asset field, select Driver and enter the driver ID.

-

Click Retrieve to view the currently assigned recurring adjustments.

-

Click Add at the top of the window.

The Assignment tab at the bottom of the window displays the asset type and asset ID you selected at the top of the window.

-

Complete the information in the following fields:

Field Definition Recurring Adjustment

Select the mileage-based per diem option.

Max Amount

If applicable, enter the maximum amount of per diem allowed.

Remainder

If you enter a maximum amount, displays the dollar amount remaining (maximum amount minus amount paid to date).

Issued

Defaults to the current date. If necessary, enter another issue date.

Adjustment Rate

Enter the per diem dollar amount.

Paid to Date

Displays the per diem dollar amount paid to date

Ref Type/Num

If applicable, select a reference number type and enter the corresponding reference number.

Acct Balance

Displays the interest amount for recurring adjustments that accrue interest.

-

Click

Save.

Save.

How a mileage-based per diem adjustment is applied

When applying a mileage-based per diem adjustment, the system does the following:

-

Counts the number of miles in the pay period.

-

Divides the total miles by the amount specified in the Quantity field.

-

Multiplies the result by the Default Rate.

In our example:

-

There are 2,400 miles in the pay period.

-

That is divided by the specified Quantity of 450.

-

That is multiplied by the Default Rate of $36.00.

The formula looks like this:

2,400 miles / 450 = 5.33 (rounded to 5.00) x $36.00 = $180.00

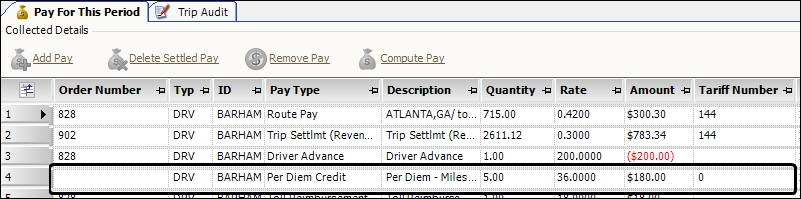

This illustration shows per diem pay for $180.00 in the Final Settlements Folder. Note that the order number is not provided in the Order Number field.