Recurring escrow adjustments

In TMW Back Office, you can set up a recurring adjustment to pay into an escrow account for a resource. For example, a company might set up escrow accounts for their owner operators to collect money for future maintenance expenses. During the Collect process, the system draws the escrow deduction from the resource’s pay.

In the Escrow Maintenance window, you can set up a recurring escrow adjustment to be deducted:

-

Per pay period

-

According to a schedule

-

By number of miles traveled on a trip

Setting up the Escrow pay type

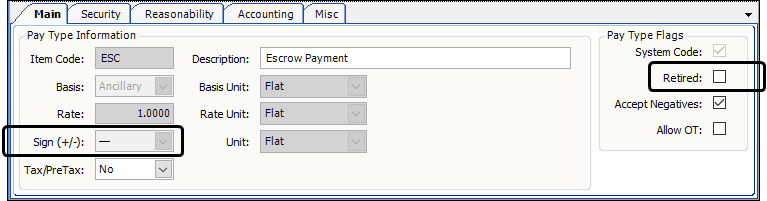

You base escrow adjustments on the existing Recurring Adjustment Escrow (RA-ESC) pay type, which is a system code. If the Recurring Adjustment Escrow (RA-ESC) pay type is retired, you must activate it. The system does not allow you to manually clear the Retired check box in the Pay Type Flags section of the Main tab. You must use a SQL statement. Contact Support for more information.

In this illustration, the Sign (+/-) field shows that the Escrow Payment pay type is for a recurring deduction (negative value). The escrow amount will be deducted from a resource’s pay.

| For detailed information, see Creating a pay type for a recurring adjustment. |

Understanding how interest adjustments are processed

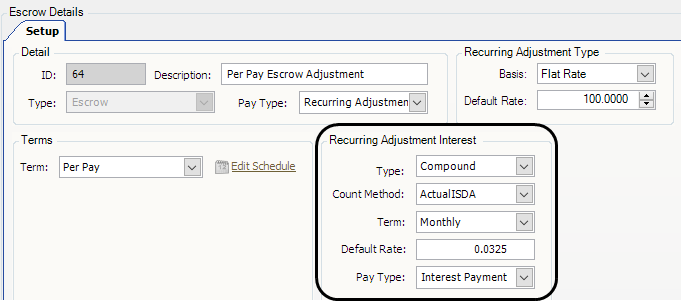

In TMW Back Office, the Escrow Maintenance feature is designed to pay interest to the resource for the money held. You enter this information in the Recurring Adjustment Interest section at the bottom of the Escrow Maintenance window.

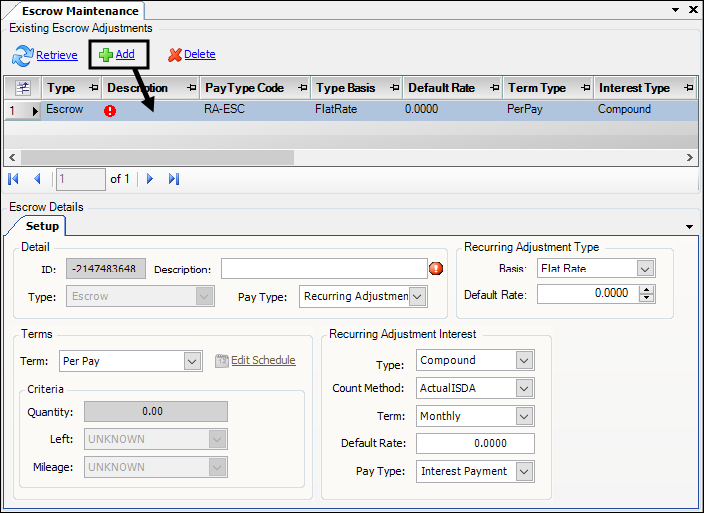

In this illustration, the Recurring Adjustment Interest section is set up to apply compound interest to the recurring escrow adjustment. The Pay Type field shows that the Interest Payment pay type is used to calculate the interest paid at a rate of 3.25%.

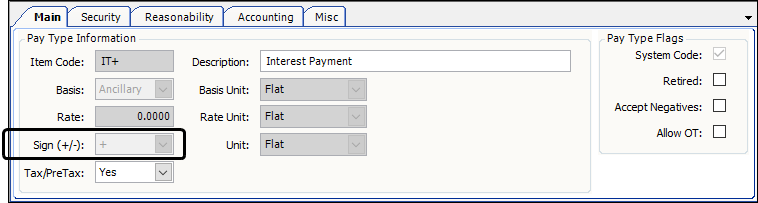

This illustration shows the Interest Payment pay type on which interest adjustments are based. This pay type is a system code. The Sign (+/-) field shows that it is for a recurring addition (positive value). When you assign a recurring escrow adjustment to a resource, any interest credited to the escrow amount will be added to total balance.

| If the Interest Payment pay type is retired, you must activate it. The system does not allow you to manually clear the Retired check box in the Pay Type Flags section of the Main tab. You must use a SQL statement. Contact Support for more information. |

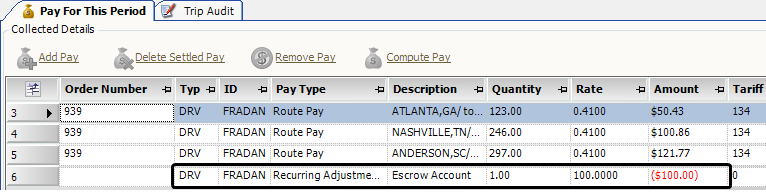

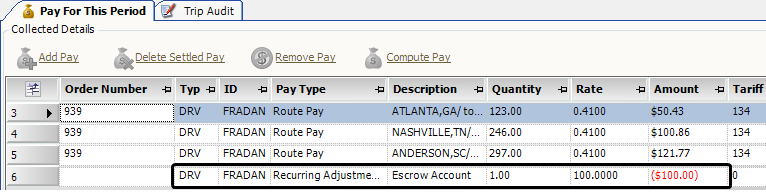

Each time a recurring escrow adjustment is processed in the Final Settlements Folder, the Collected Details section displays a detail line for the escrow amount deducted from the resource’s pay.

To see the interest paid on the escrow account, display the resource in the Assign Assets window. Interest is displayed in the Transactions tab. For details, see Viewing escrow transactions.

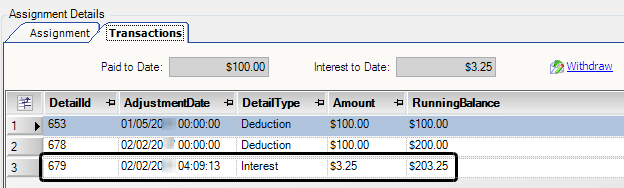

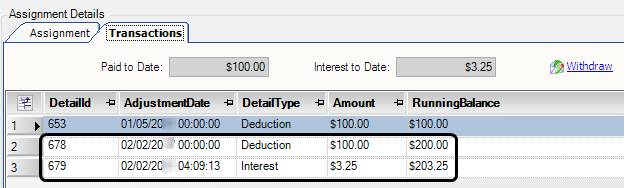

In this illustration, interest in the amount of $3.25 has been paid into an escrow account with a balance of $200.00.

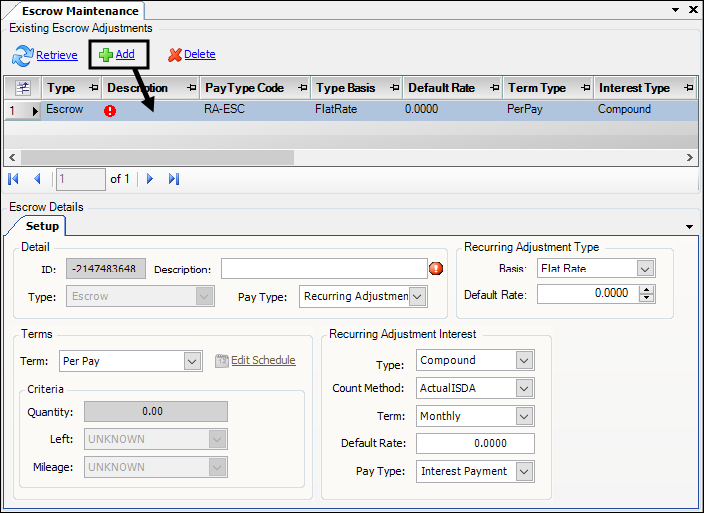

Creating a recurring escrow adjustment

To set up a recurring escrow adjustment, follow these steps.

-

Go to Tools > Setup > Recurring Adjustments > Escrow Maintenance.

The Escrow Maintenance window opens. -

Click Retrieve to view existing recurring escrow records.

-

Click Add at the top of the window.

A blank record is added.

-

In the Escrow Details section, enter information about the recurring escrow adjustment.

Required field: *

Read-only field: §

Field Definition Detail section

Enter information about the escrow.

ID

System-assigned numeric ID for the escrow account, created when you save the new record

Description *

Enter a brief description of the escrow account

Type §

Defaults to Escrow

Pay Type

Select the Escrow Payment pay type.

Recurring Adjustment Type section

Basis

Select an option for calculating the recurring escrow adjustment:

-

Flat Rate

Apply the same flat dollar amount each time pay is processed. -

% Pay

To calculate the amount, the system totals all taxable earnings for the settlement period and multiplies that sum by the specified percentage.

Default Rate

Use this field to specify a default escrow rate for all resources.

Do one of the following:

-

If Basis is Flat Rate, enter a flat dollar amount.

-

If Basis is % Pay, enter the percentage as a decimal. For example, for 4%, enter 0.0400.

-

If the recurring pay adjustment does not use a default rate, leave the default entry 0.0000.

Note: You can edit the amount on a resource-by-resource basis when you assign the recurring escrow adjustment.

Terms section

Term

Specify when the system should apply the recurring escrow adjustment.

-

Per Pay

Apply each time you run the Collect process. -

Schedule

Apply based on a schedule that you define.To define a recurring pay schedule, click Edit Schedule. For details, see Setting up a recurring escrow adjustment schedule.

-

Per Miles

Apply to trips based on the number of miles traveled.

Criteria section

When you select Per Miles, in the Term field, the system activates the Criteria section fields.

Quantity

The default is 1.00.

For Per Miles, the deduction is applied once for each mile on each trip for which pay is issued. The deduction rate is multiplied by the total number of miles.

Enter a different quantity to apply the deduction based on a specific number of miles. For example, you would enter 500 to apply a recurring deduction for every 500 miles driven.

Left

Applies rounding when Quantity is something other than 1.

Select the rounding method used when the number of miles is not evenly divisible by the Quantity number.

-

Round Near

Round the number up or down to the nearest whole number. -

Round Up

Round the number up to the next whole number. -

Round Down

Round the number down to the preceding whole number.

For example, if Quantity is 500 and the number of miles is 1,200, the result is 2.4 (1200 ÷ 500 = 2.4).

-

If you select Round Near, the number rounds down to 2.

The system applies the adjustment 2 times. -

If you select Round Up, the number rounds up to 3.

The system applies the adjustment 3 times. -

If you select Round Down, the number rounds down to 2.

The system applies the adjustment 2 times.

Mileage

Identifies which type of miles is counted when a mileage-based escrow deduction is calculated. Options are:

-

Any

Use both loaded and empty miles to calculate a recurring deduction. This includes all miles driven, even if line haul pay for one or more trips is not based on miles. -

Empty

Use only empty miles. This includes all empty miles driven, even if line haul pay for one or more trips is not based on miles. -

Loaded

Use only loaded miles. This includes all loaded miles driven, even if line haul pay for one or more trips is not based on miles. -

Hub

Count hub miles. This includes all hub miles driven, even if line haul pay for one or more trips is not based on hub miles. -

Paid

Count only those miles for which mileage-based line haul pay was issued during the pay period. The system totals all miles used to create mileage-based line haul pay, even if that number is different from the actual miles driven.

Recurring Adjustment Interest section

Specify how interest will be calculated for a resource’s escrow account.

Type

Specify how escrow interest will be calculated.

-

Compound

Calculate interest on both the escrow’s principal amount and the accumulated interest of previous payment periods. -

Simple

Calculate interest only on the escrow’s principal amount.

Count Method *

Defines how interest is calculated.

-

ActualISDA (default)

Use the Actual/Actual ISDA accrual method and day count convention. -

ActualFixed365

Use the Actual/365 (fixed) accrual method and day count convention.

Term

Specify when the system should apply interest.

-

Yearly

Calculate and apply interest once a year. -

Monthly

Calculate and apply interest once a month. -

Weekly52

Calculate and apply interest once a calendar week. -

Weekly365By7

Calculate and apply interest every 7 days, beginning from the date the escrow adjustment was issued to the resource. -

Daily365

Calculate and apply interest once each day.

Default Rate

Enter the default interest rate for the recurring escrow adjustment. For example, for 3.25%, you would enter 0.0325

Note: If the escrow account should not pay interest, enter 0.0000 in the Default Rate field.

Pay Type

Select Interest Payment.

Any interest credited to the escrow account will be added to the escrow balance. You can view interest paid in the Transactions tab of the Assign Assets window.

Note: For details about applying interest to escrow accounts, see Understanding how interest adjustments are processed.

-

-

Click

Save.

Save.

Setting up a recurring escrow adjustment schedule

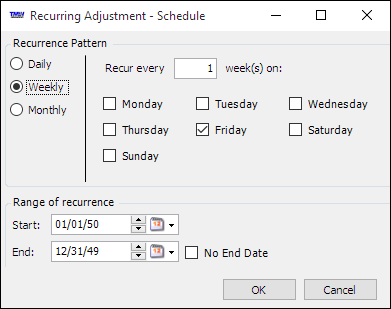

Selecting Schedule in the Term field activates the Edit Schedule button. When you click Edit Schedule, the Recurring Adjustment - Schedule window opens.

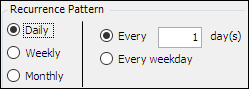

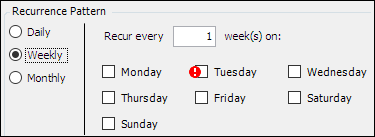

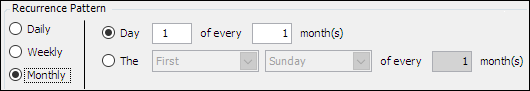

Use the options in the Recurrence Pattern and Range of recurrence sections to set up a schedule for the recurring escrow adjustment.

| Field | Definition |

|---|---|

Recurrence Pattern |

Indicate how often the recurring escrow adjustment will be processed. The fields on the right side of the section vary according to your selection. |

Daily |

These options display on the right side of the window:

|

Weekly |

On the right side of the window:

|

Monthly |

These options display on the right side of the window:

|

Range of recurrence |

|

Start |

Enter the beginning date for the recurring escrow schedule. Note: Set the start date to the pay period before the first recurring escrow adjustment is to be processed. |

End |

Enter the ending date for the recurring escrow schedule. Note: If the recurring escrow schedule should continue indefinitely, select the No End Date check box. |

To save the schedule, click OK in the Recurring Adjustment - Schedule window.

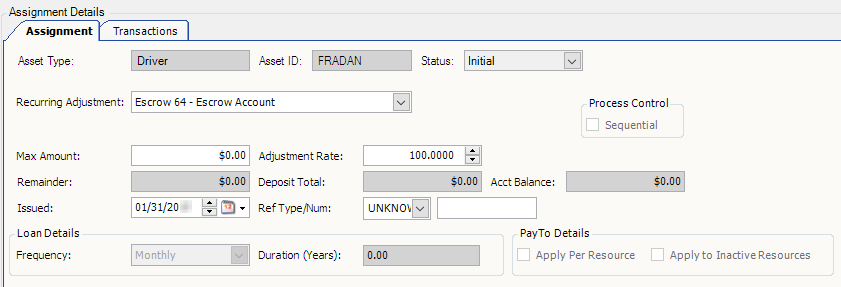

Assigning a recurring escrow adjustment to a resource

Your company’s lending requirements and pay setup determine escrow amounts and interest rates. These can vary for each resource that you assign a recurring escrow adjustment.

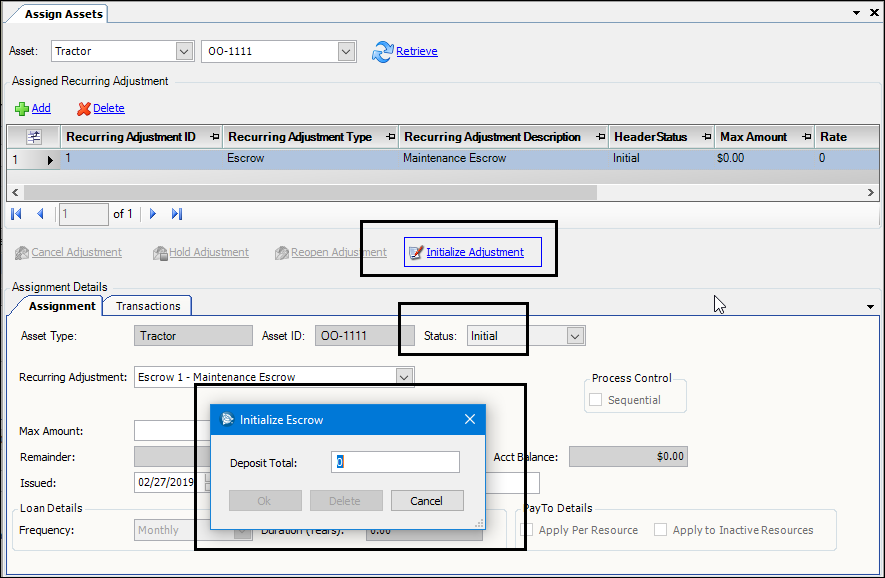

| While assigning a recurring escrow adjustment, you can record an initial escrow deposit. The escrow adjustment must have a status of Initial. Once that status is Drawn, you can no longer make an initial escrow adjustment. For more information, see [RecordingInitialEscrow]. |

To assign a recurring escrow adjustment:

-

Go to Tools > Setup > Recurring Adjustments > Recurring Adjustment Assign Asset.

The Assign Assets window opens. -

Make entries in the Asset fields at the top of the window:

-

In the first field, select the resource type.

-

In the second field, enter the resource ID.

-

-

Click Retrieve to view the resource’s assigned recurring adjustments.

-

Click Add at the top of the window.

The Assignment tab at the bottom of the window displays the resource type and resource ID you selected at the top of the window.

-

Complete the information in the following fields.

Field Definition Recurring Adjustment

Select a recurring escrow adjustment.

Max Amount

Enter the total escrow amount to be deducted from resource pay.

Adjustment Rate

Enter the escrow amount to be deducted per transaction.

Remainder

If you entered an amount in the Max Amount field, the outstanding dollar amount is shown here. The value is calculated as:

maximum amount minus amount paid to date

Deposit total

The total amount of escrow that has been deducted to date

Acct Balance

The total amount of escrow plus interest that has been accrued to date

Issued

Defaults to the current date. If necessary, enter another issue date.

Ref Type/Num

If applicable, select a reference number type in the first field. In the second field, enter the reference number.

Note: The fields in the Loan Details and Pay To Details sections are not used with recurring escrow adjustments.

-

Depending on whether you want to record an initial escrow deposit amount, do one of the following.

If you do not want to record an initial escrow amount

You can make initial deposits only when the escrow adjustment has a status of Initial. Once that status is Drawn, you can no longer make an initial escrow adjustment.

-

Click

Save.

Save. -

Click

Close.

Close.

If you want to record an initial escrow deposit

-

Click Initialize Adjustment.

The Initialize Escrow window opens.

-

Enter the amount of the initial deposit into the Deposit Total field.

Note: If a maximum amount is set for the recurring adjustment, the amount you enter here must be less than the maximum amount.

-

Click OK.

-

Click

Save.

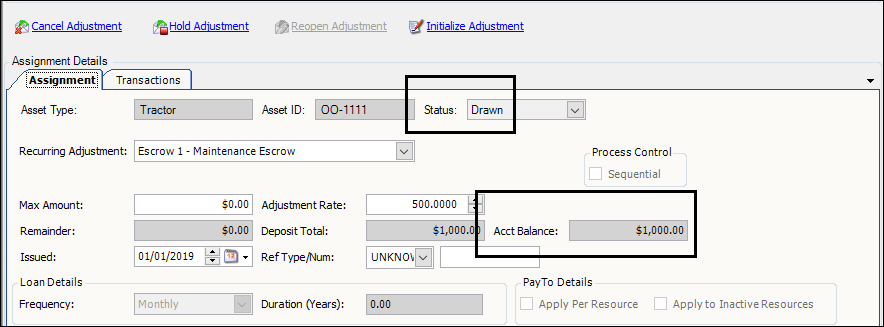

Save.Notice that the Status field changes to Drawn and the Acct Balance field shows the amount of your initial deposit.

-

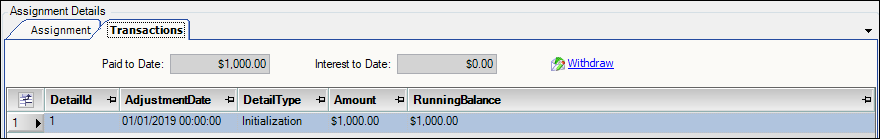

Click the Transaction tab to see transaction details.

How a recurring escrow adjustment is applied

When you run the Collect process in the Final Settlements Folder, the system generates one detail line for the recurring escrow adjustment. The detail line displays the escrow amount deducted from the resource’s pay.

In this illustration, the settlement details show an escrow payment of $100.00.

Viewing escrow transactions

At any time, you can display the settlements transactions for the escrow adjustments assigned to a resource.

-

Go to Tools > Setup > Recurring Adjustments > Recurring Adjustment Assign Asset.

The Assign Assets window opens. -

Select the Transactions tab.

In this illustration, $200.00 in escrow payments and $3.25 interest have been added to the escrow account.

Recalculating interest payments to include an initial withholding amount

First available in version 2021.2

Before V.2021.2, when the system calculated interest it did not include the amount of the initial escrow deposit. The calculation was based only on later escrow deposits.

Starting in V.2021.2, escrow accounts include the initial deposit when calculating interest.

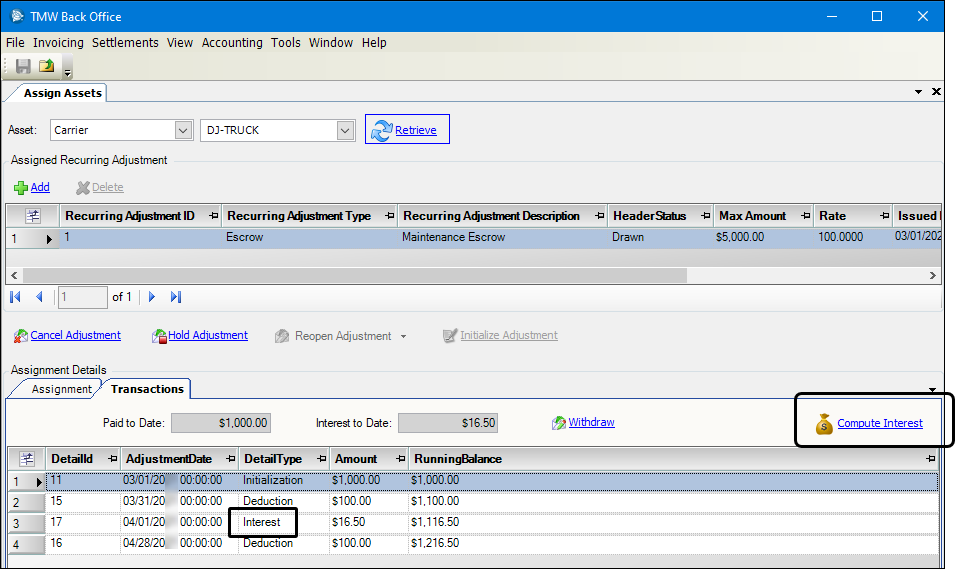

You can also set up the system to show the Compute Interest button. You use it to recalculate interest on existing escrow accounts. The recalculation will include the initial escrow deposit, when appropriate. The button appears on the Assign Assets window’s Transaction tab. To make it available, you must have the String1 field for the EscrowComputeButtonToggle General Info Table setting set to Y.

The button is available only when a recurring adjustment for escrow has a pay detail for Interest.

Click the Compute Interest button to recalculate pay details for Interest on the Transaction tab.

Trimble best practice recommendation:

-

Only activate the

EscrowComputeButtonTogglesetting when you must fix existing escrow interest details computed in versions before 2021.2. -

Do not use the Compute Interest button routinely when working with recurring escrow adjustments.