Recurring loan adjustments

In TMW Back Office, you can set up a recurring adjustment to repay one or more loans for a company resource. By default, when you set up multiple loans for a resource, a deduction for each loan is applied to the resource’s final settlements record.

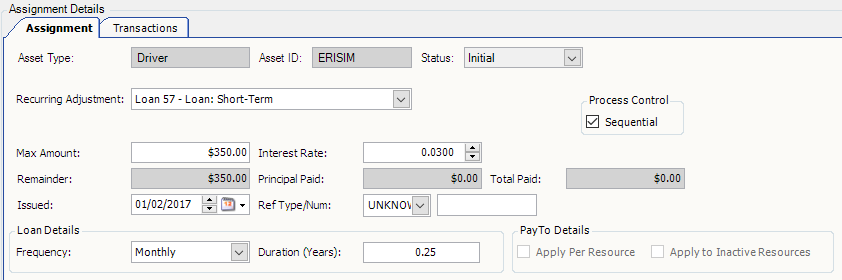

Alternatively, the Sequential option in the Loan Maintenance window allows you to assign multiple loans to be paid in succession. For example, two loans marked Sequential are assigned to the driver ERISIM, one for $500 and another for $350. Because it has an earlier issue date, payments for the $500 loan are processed first. The $500 loan must be paid in full before the first payment for the $350 loan can be processed.

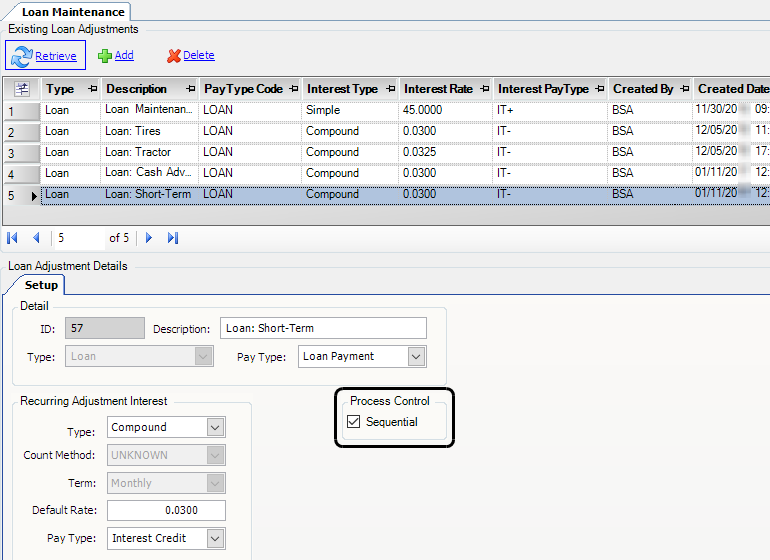

In the Loan Maintenance window, select the Sequential check box for each loan to be applied sequentially.

Setting up the Loan pay type

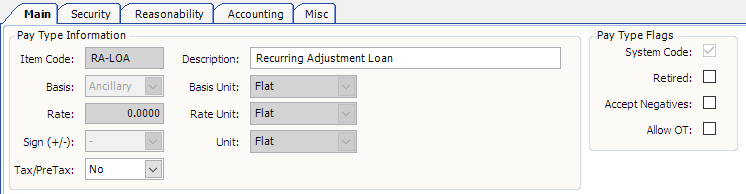

The Recurring Adjustment Loan (RA-LOA) pay type has been set up as a system code. Because this pay type already exists, you do not have to create any other loan-related pay types.

In this illustration, the Sign (+/-) field shows that the Loan Payment pay type is for a recurring deduction (negative value). The loan amount will be deducted from a resource’s pay.

|

How the Interest Credit pay type works

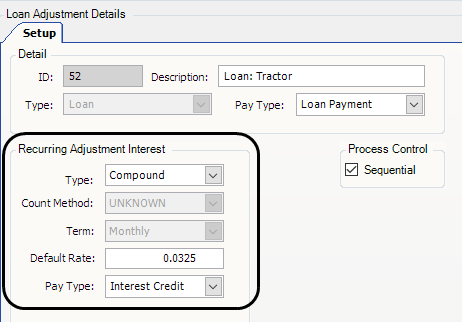

If a loan includes interest, you specify how the interest will be applied to the loan. You enter this information in the Recurring Adjustment Interest section at the bottom of the Loan Maintenance window.

In this illustration, the Recurring Adjustment Interest section is set up to apply compound interest to the recurring loan adjustment. The Pay Type field shows that the Interest Credit pay type is used to calculate the interest paid at a rate of 3.25%.

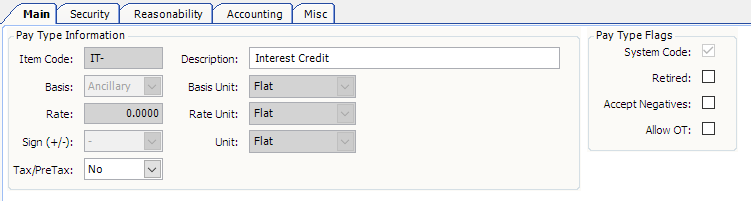

In this illustration of the Interest Credit pay type, the Sign (+/-) field shows that it is for a recurring deduction (negative value). When you assign a loan to a resource, the interest paid with each loan payment will be deducted from the total interest due for the loan.

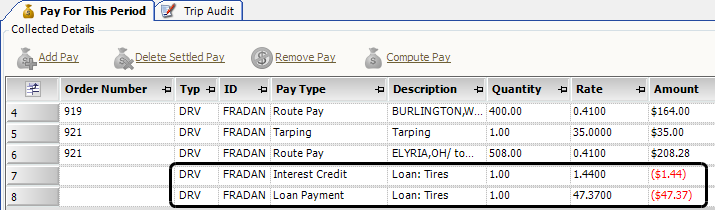

Each time a loan is processed in the Final Settlements Folder, the Collected Details section displays two detail lines: one for the interest paid and another for the principal amount paid.

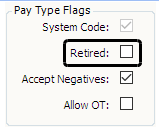

| Because the Interest Credit pay type is a system code, you do not have to create another pay type. If the Interest Credit pay type is retired, you must activate it. The system does not allow you to manually clear the Retired check box in the Pay Type Flags section of the Main tab. You must use a SQL statement. Contact Support for more information. |

Creating a recurring loan adjustment

To set up a recurring loan adjustment, follow these steps.

-

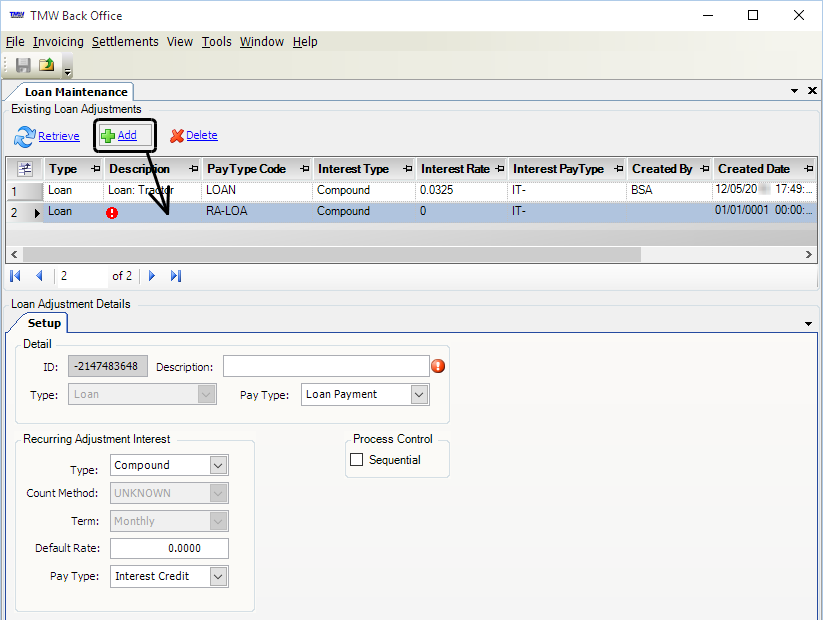

Go to Tools > Setup > Recurring Adjustments > Loan Maintenance.

The Loan Maintenance window opens. -

Click Retrieve to view existing recurring loans.

-

Click Add at the top of the window.

A blank record is added.

-

In the Loan Adjustment Details section, enter information about the loan and about how interest will be calculated for the loan.

-

In the Detail section, enter information about the loan.

Required field: *

Field Definition ID

System-assigned numeric ID for the loan, created when you save the new record

Description[blue]*

Enter a brief description of the loan.

Type

Read-only field; defaults to Loan

Pay Type

Select the Loan pay type.

-

In the Recurring Adjustment Interest section, specify how the system will calculate interest for the loan.

Field Definition Type

Specify how interest on the loan will be calculated.

-

Compound

Calculate interest on both the loan’s principal amount and the accumulated interest of previous payment periods. -

Simple

Calculate interest only on the loan’s principal amount.

Count Method

Read-only field; defaults to UNKNOWN

Term

Read-only field; defaults to Monthly

Default Rate

Enter the loan’s default interest rate. For example, for 3.25%, you would enter 0.0325

Pay Type

Select Interest Credit.

Any interest paid with a loan payment will be deducted from the total interest due for the loan.

Note: For details, see How the Interest Credit pay type works.

-

-

Select the Sequential check box to apply the loan sequentially when running the Collect process for a pay period.

When two or more sequential loans are assigned to a resource, the first sequential loan must be paid in full before the first payment for the next sequential loan can be processed

-

-

Click Save.

Assigning a recurring loan adjustment to a resource

When you assign a recurring loan adjustment to a resource, the loan amount and interest rate can vary for each resource, based on your company’s lending requirements and pay setup.

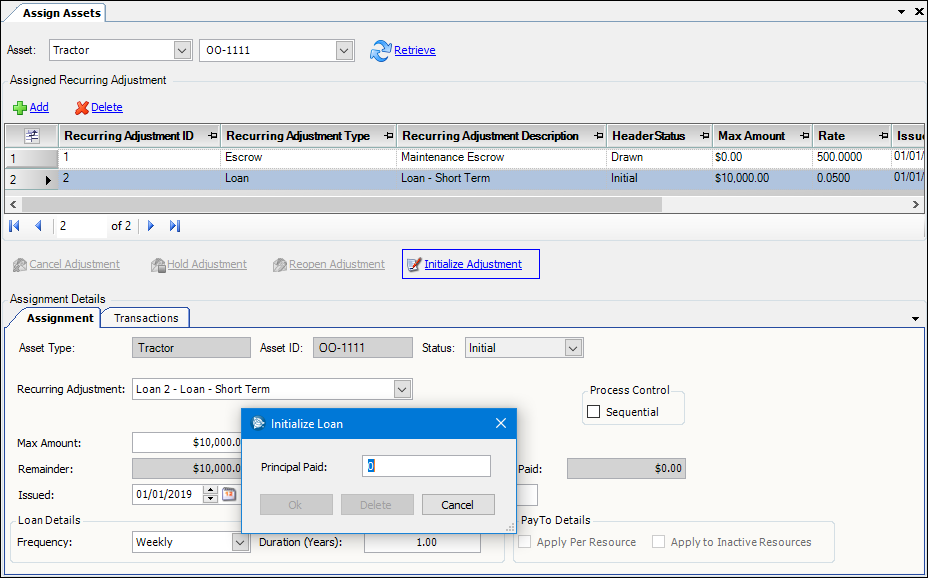

| While assigning a recurring loan adjustment, you can record an initial payment. The loan adjustment must have a status of Initial. Once that status is Drawn, you can no longer make an initial loan payment. For more information, see To record an initial loan payment. |

To assign a recurring loan adjustment:

-

Go to Tools > Setup > Recurring Adjustments > Recurring Adjustment Assign Asset.

The Assign Assets window opens. -

Make entries in the Asset fields at the top of the window:

-

In the first field, select the resource type.

-

In the second field, enter the resource ID.

-

-

Click Retrieve to view the currently assigned recurring adjustments.

-

Click Add at the top of the window.

The Assignment tab at the bottom of the window displays the resource type and resource ID you selected at the top of the window.

-

Complete the information in the following fields.

Field Definition Recurring Adjustment

Select a recurring loan adjustment.

Max Amount

Enter the loan amount.

Interest Rate

Defaults to the interest rate entered in the Loan Maintenance window.

If necessary, enter a different interest rate. For example, for 3.25%, enter 0.0325.

Remainder

If you entered an amount in the Max Amount field, the outstanding dollar amount of the loan still owed is shown here. The value is calculated as:

maximum amount minus amount paid to datePrincipal Paid

The total amount of the loan principal that has been paid to date

Total Paid

The total amount of principal plus interest that has been paid to date

Issued

Defaults to the current date. If necessary, enter another issue date.

Ref Type/Num

If applicable, select a reference number type in the first field. In the second field, enter the corresponding reference number.

-

In the Loan Details section, complete the information in the following fields.

Field Definition Frequency

Select the payment frequency. Options include:

-

Daily365

A loan payment will be deducted once each day. -

Weekly

A loan payment will be deducted once each week. -

Monthly

A loan payment will be deducted once each month -

Quarterly

A loan payment will be deducted once every three months. -

Yearly

A loan payment will be deducted once each year.

Duration (Years)*

Enter the number of years in the loan.

Note: The fields in the Pay To Details section are not used with recurring loan adjustments.

-

-

Depending on whether you want to record an initial loan payment, do one of the following.

If you do not want to record an initial loan payment amount

| You can make initial loan payments only when the deduction adjustment has a status of Initial. Once that status is Drawn, you can no longer make an initial loan adjustment. |

-

Click

Save.

Save. -

Click

Close.

Close.

If you want to record an initial loan payment

-

Click Initialize Adjustment.

The Initialize Loan window opens.

-

Enter the amount of the initial loan payment into the Principal Paid field.

Note: If a maximum amount is set for the recurring adjustment, the amount you enter here must be less than the maximum amount.

-

Click OK.

-

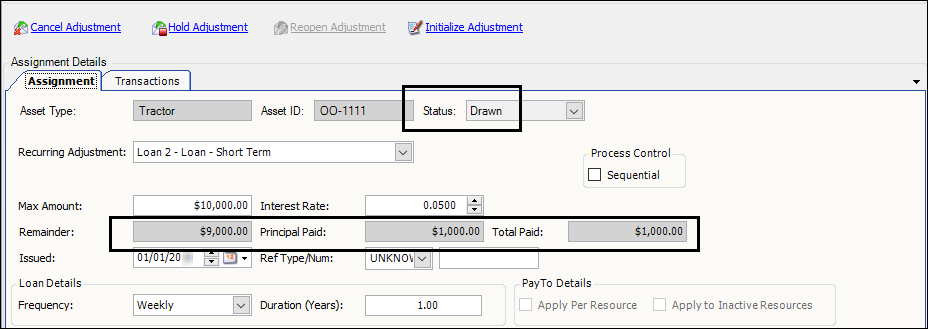

Click

Save.

Save.Notice that the Status changes to Drawn and the Remainder, Principal Paid, and Total Paid fields are adjusted by your initial payment.

-

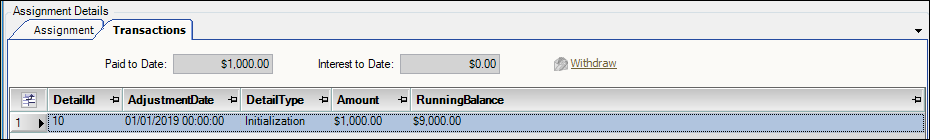

Click the Transaction tab to see transaction details.

How a recurring loan adjustment is applied

When you run the Collect process in the Final Settlements Folder, the system generates two detail lines for the recurring loan adjustment.

-

The first detail line displays the amount paid toward the loan interest.

-

The second detail line displays the amount paid toward the loan principal.

In this illustration, the settlement details show an interest credit payment of $1.44 and a payment of $47.37 towards the principal for a tire loan.

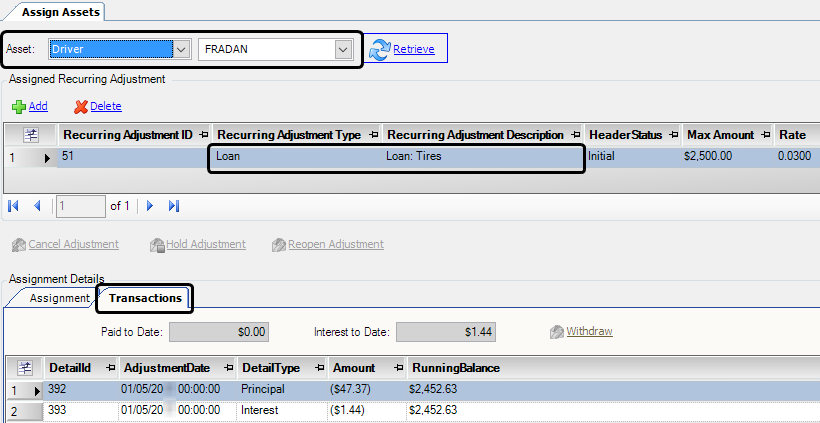

At any time, you can display the settlements transactions for the loans assigned to a resource.

-

Go to Tools > Setup > Recurring Adjustments > Recurring Adjustment Assign Asset.

The Assign Assets window opens. -

In the Asset fields at the top of the window, select the resource type and enter the resource ID.

-

Click Retrieve to view the currently assigned recurring adjustments.

-

In the Assigned Recurring Adjustment section, select the recurring adjustment.

-

Select the Transactions tab.

In this illustration, the remaining balance on a $2,500.00 loan is $2,452.63.

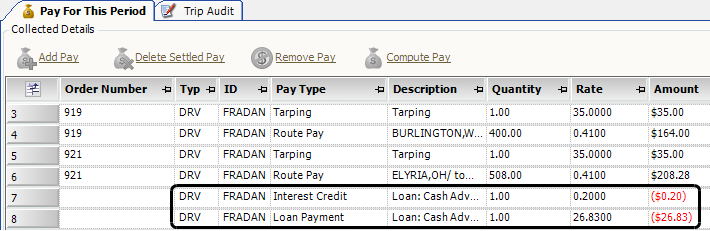

How sequential loans are applied

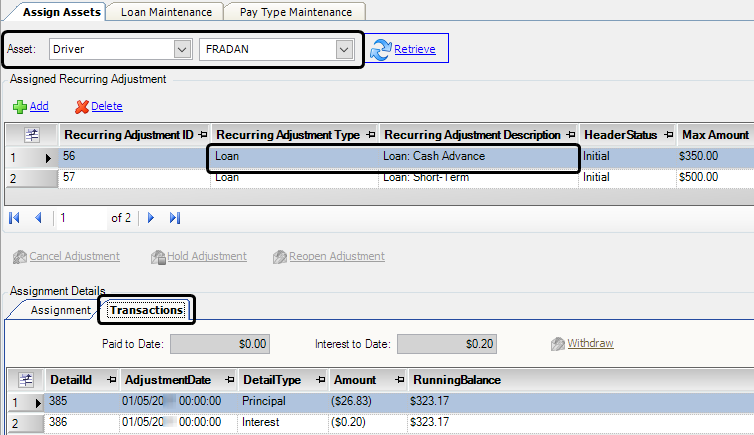

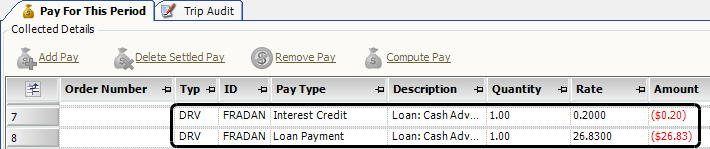

In this example, two loans marked Sequential have been assigned to the driver FRADAN:

-

A cash advance loan for $500.00 (issued on November 1)

-

A second loan for $350.00 (issued on December 15)

Because it was issued first, the $500.00 loan must be paid in full before the first payment for the $350.00 loan can be processed.

When we run the Collect process in the Final Settlements Folder, the system generated two detail lines for the cash advance loan:

-

The first detail line displays the amount paid toward the loan interest.

-

The second detail line displays the amount paid toward the loan principal.

This illustration shows an interest credit payment of $0.20 and a payment of $26.83 towards the loan principal.

At any time, you can display the settlements transactions for the loans assigned to a resource.

-

Go to Tools > Setup > Recurring Adjustments > Recurring Adjustment Assign Asset.

The Assign Assets window opens. -

In the Asset fields at the top of the window, select the resource type and enter the resource ID.

-

Click Retrieve to view the currently assigned recurring adjustments.

-

In the Assigned Recurring Adjustment section, select the recurring adjustment.

-

Select the Transactions tab.

In this illustration, the remaining balance on a $350.00 loan is $323.17.