Setting up a Premium Day rate table for holiday pay

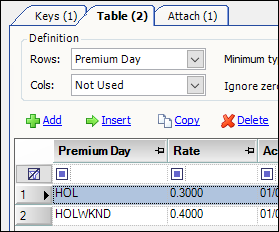

You can set up a Premium Day rate table for holiday pay. You define the table’s rows or columns by Premium Day. Then you record a rate for Holidays (HOL) and/or Holidays on Weekends (HOLWKND).

You can use the Premium Day option for primary or secondary rate tables that create pay in the Trip Settlements Folder when you run the compute function. You can base these rates on distance, flat amount, etc.

|

Creating a flat rate for Premium Day holiday pay

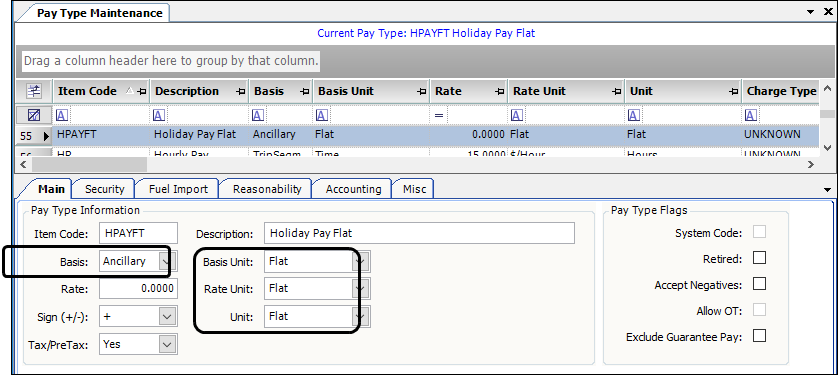

You can set up a pay type for use with a flat accessorial pay rate.

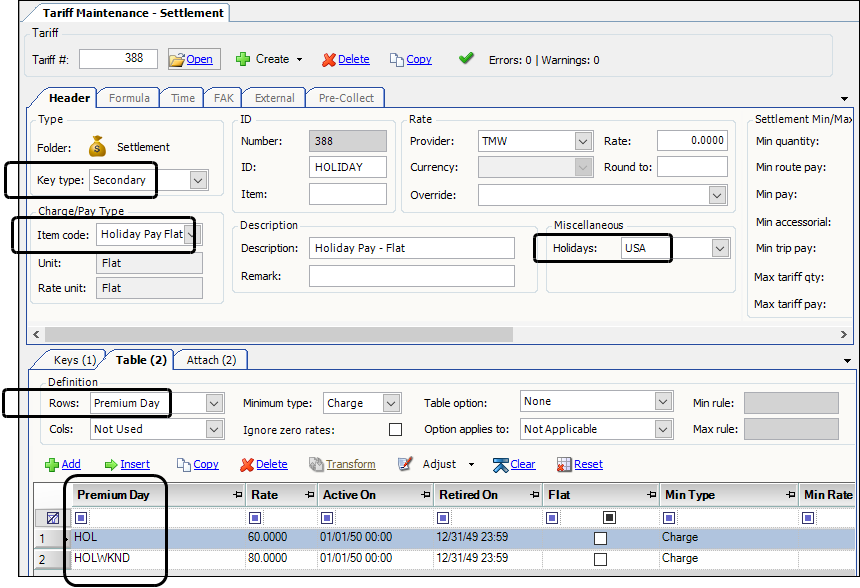

You could use that pay type to set up a flat secondary pay rate. This rate calculates additional pay when a stop on a trip falls on a holiday. For this rate:

-

The holiday schedule is specified in the Holidays field.

Note: Before creating your Premium Day rates for holidays, you must set up a holiday schedule specifying the days eligible for holiday pay.

-

The rate table’s rows are defined by Premium Day. Two rates are recorded in the table:

-

HOL (Holiday) pays $60 accessorial pay

-

HOLWKND (Holiday on Weekend) pays $80 accessorial pay

-

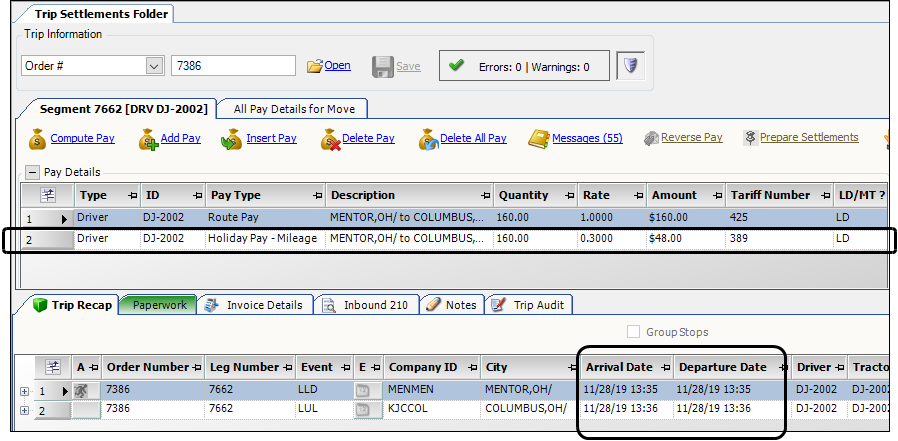

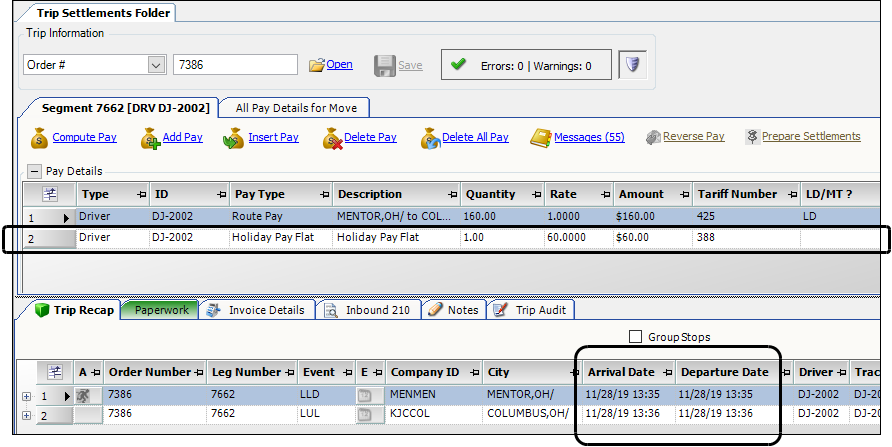

This illustration shows the holiday pay rate #388 applied to a trip that arrived on a holiday (Thanksgiving Day). Notice that the holiday pay is in addition to the driver’s regular Route Pay.

Creating a mileage-based rate for Premium Day holiday pay

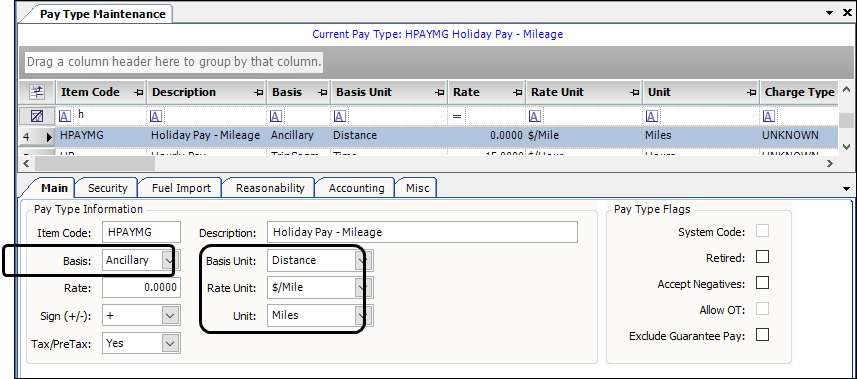

You can set up a pay type for a mileage-based accessorial pay rate.

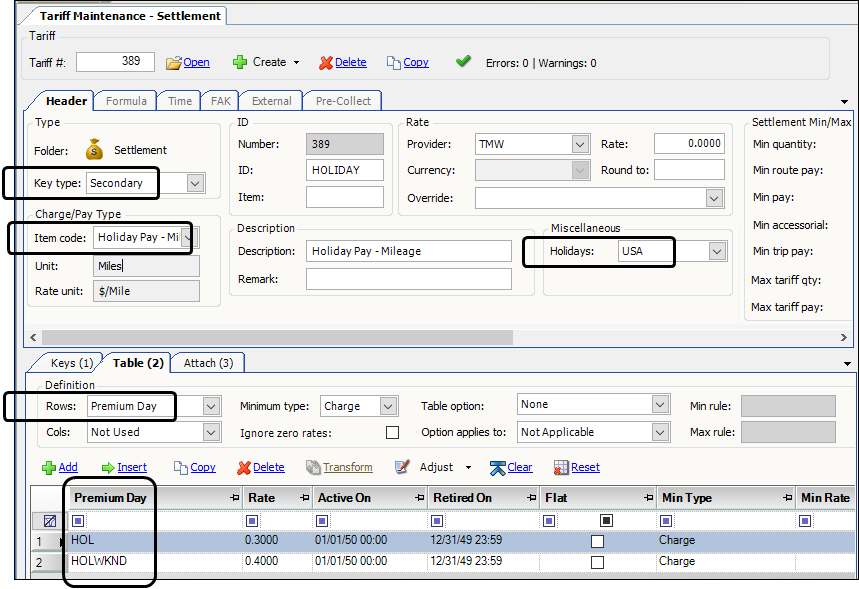

You can use that pay type to set up a mileage-based secondary rate. This rate calculates additional pay when a stop on a trip falls on a holiday. For this rate:

-

The holiday schedule is specified in the Holidays field.

Note: Before creating your Premium Day rates for holidays, you must set up a holiday schedule specifying the days eligible for holiday pay.

-

The rate table’s rows are defined by Premium Day. Two rates are recorded in the table:

-

HOL (Holiday) pays $0.30 per mile for accessorial pay

-

HOLWKND (Holiday on Weekend) pays $0.40 per mile for accessorial pay

-

This illustration shows the holiday pay rate #389 applied to a trip that arrived on a holiday (Thanksgiving Day). Notice that the holiday pay is in addition to the driver’s regular Route Pay.