Pay To

Access method:

-

Go to Tools > Pay To Scroll.

-

Press CTRL+SHIFT+P.

-

Place the cursor in a pay to field and press CTRL+ALT+S.

-

Place the cursor in a pay to field, right-click in the field, and select View Scroll.

The system retrieves records that match all restrictions entered on all sub tabs, not just those restrictions set on the sub tab currently in view.

| The Profile button is not available for Pay To scrolls. |

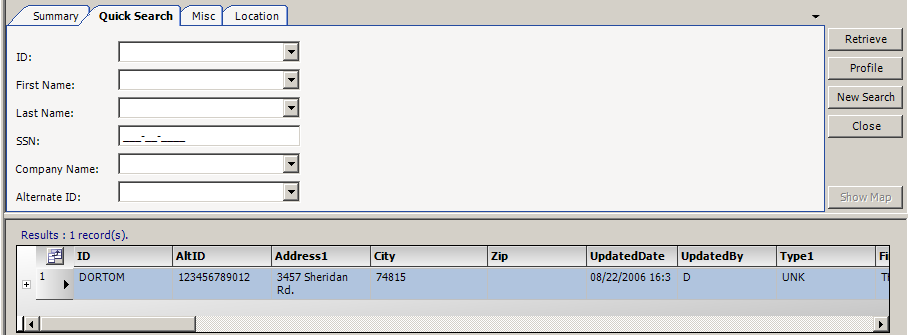

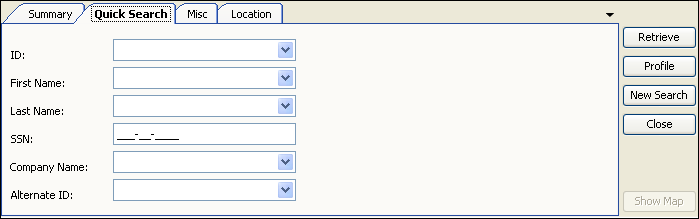

Pay To scroll - Quick Search tab

Use this sub tab to set restrictions based on Pay To ID, name or tax number.

ID |

Pay To ID. |

First Name |

Pay To’s first name (for an owner operator). |

Last Name |

Pay To’s last name (for an owner operator). |

SSN |

Pay To’s tax ID or, for an individual, the Social Security Number. |

Company Name |

Pay To’s company name. |

Alternate ID |

Alternative identification code used to identify the Pay To. This code may represent an ID from another computer system, such as an accounting ID. |

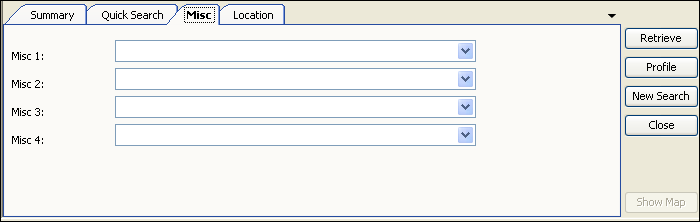

Pay To scroll - Misc tab

Use this sub tab to set restrictions based on free-form comments recorded in user-defined fields.

Misc 1-4 |

Comments recorded for the Pay To. Note: Field names are set up in the PayToMisc 1- 4 labels in System Administration. |

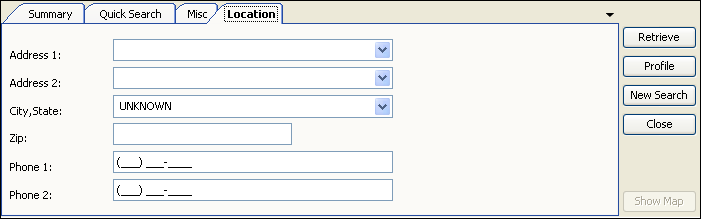

Pay To scroll - Location tab

Use this tab to set restrictions based on address and/or phone number.

Address 1 |

First line of the Pay To’s street address. |

Address 2 |

Second line of the Pay To’s street address. |

City, State |

The company’s city, state/province, and county. Note: The county designation appears when a state has more than one city with the same name. |

Zip |

The company’s ZIP/postal code. |

Phone 1 |

Pay To’s primary phone number. |

Phone 2 |

Additional phone number for the Pay To; for example, fax number. |