AR Adjustments Register

Use AR Adjustments Register to update AR adjustments created in AR Adjustments. The posting process generates entries in GL Journal Entries.

The register also updates the freight bill record in AR Inquiry.

You can reprint past AR adjustment registers.

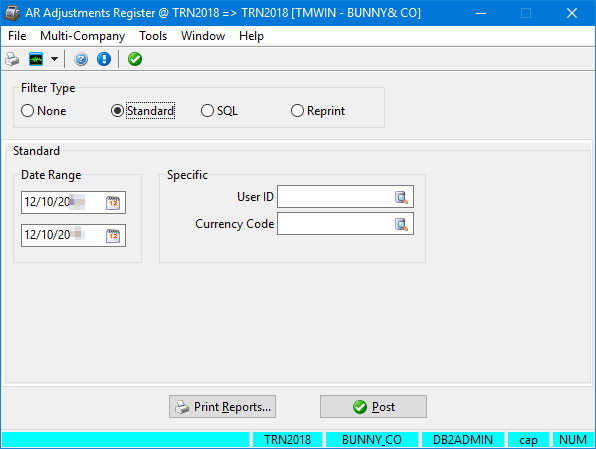

Several different filter types are available. The fields that appear differ depending on the filter type. This illustration shows the fields that appear when you select the standard filter (default).

To access AR Adjustments Register:

| From this location | Go to |

|---|---|

TruckMate Menu and TruckMate Task List |

Accounting & Finance > Accounts Receivable > AR Adjustments Register |

Windows Start Menu |

TruckMate 20xx > AR Adjustments Register |

Windows Explorer |

C:\Program Files (x86) > TruckMate 20xx > Arrau.exe |

Setting up Application Configurator for use with AR Adjustments Register

The following Application Configurator options for AR Adjustments Register are listed under Configuration Options > ARRAU.EXE.

Allow Inactive GL |

Determines system behavior when the user attempts to use an inactive General Ledger (GL) account. Options are:

|

Auto-Correct Closed Period Posting Dates - Past |

Determines how AR Adjustments Register handles "bad" past dates. Options are:

|

Auto-Correct Closed Period Posting Dates - Future |

Determines how AR Adjustments Register handles "bad" future dates. Options are:

|

Commit Each Trans |

When this option is set to False, the system commits all transactions at once, rather than separately. |

Subtotal GLTRANS Postings |

When this option is set to True, all of the GL transactions in the register are grouped/summed together by GL account and date (creating a single total per combination). If left at the default, transactions are grouped by GL account, date, and source transaction ID. |

Posting AR adjustments

The general process for posting AR adjustments in AR Adjustments Register is:

-

Select a filter type. Options are:

-

None

-

Standard

-

SQL

-

-

Enter one or more search criteria, as described below.

-

If you want, review the adjustments register report for accuracy prior to posting.

-

Click Post.

-

After you have finished reviewing the reports, close the report windows.

A message appears indicating that the posting is complete.

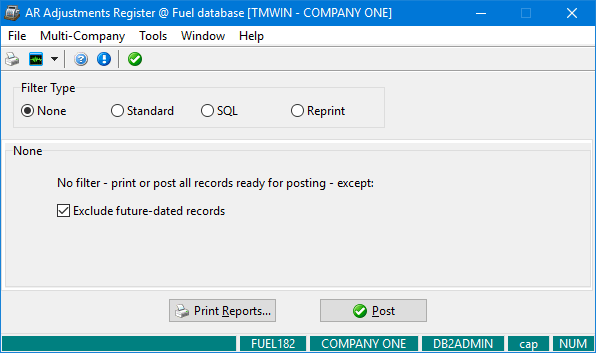

Posting AR adjustments without using a filter

-

In the Filter Type section, select None.

The AR Adjustments Register window redisplays as shown in this illustration.

-

By default, future-dated records are excluded. If you want to include them, deselect Exclude future-dated records.

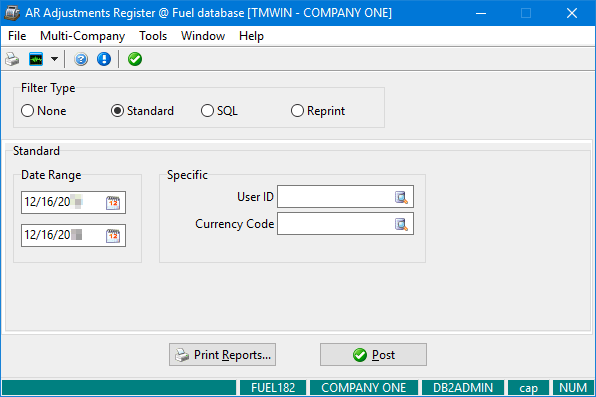

Posting AR adjustments using the standard filter

-

In the Filter Type section, select Standard if it is not already selected.

The AR Adjustments Register window redisplays as shown in this illustration.

-

Enter one or more filter criteria. Note that the more criteria you enter, the narrower the results.

Field Definition Date Range

Enter valid dates or click

Calendar to search for and select a date.

Calendar to search for and select a date.User ID

Enter the ID of a user who entered the adjustments. You can also click

Pick List to search for and select a user ID.

Pick List to search for and select a user ID.Currency Code

Enter a valid currency code or click

Pick List to search for and select a currency code.

Pick List to search for and select a currency code.

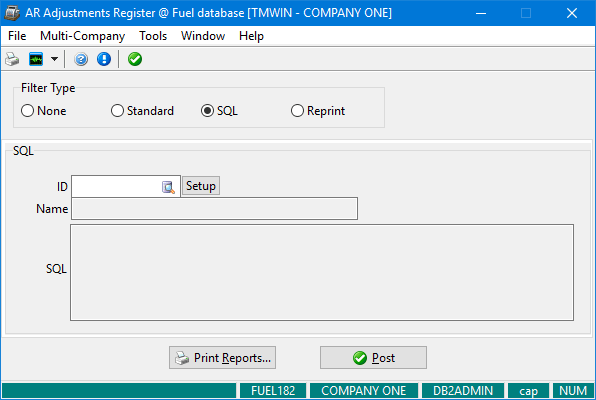

Posting invoices using the SQL filter

-

In the Filter Type section, select SQL.

The AR Adjustments Register window redisplays as shown in this illustration.

-

Do any of the following:

-

Enter a valid custom SQL filter ID.

-

Click

Pick List to search for and select a custom SQL filter ID.

Pick List to search for and select a custom SQL filter ID. -

Click Setup and create a custom SQL filter in the SQL Filter window.

The name of the SQL filter and its corresponding SQL code appear in the Name and SQL fields.

-

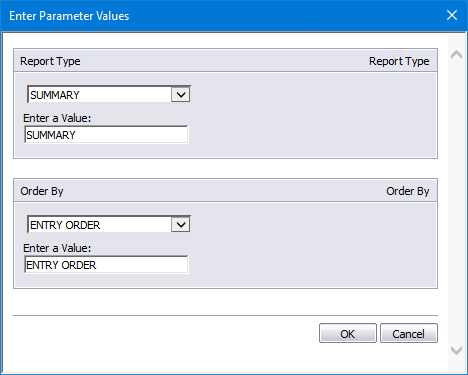

Printing and reprinting reports in AR Adjustments Register

To see reports listing adjustments that meet your search criteria:

-

Click Print Reports.

The Enter Parameter Values window displays.

-

In the Report Type field, select the type of report:

-

Summary

-

Detailed

-

-

In the Order By field, select the order:

-

Entry Order

-

Bill Number

-

Client ID

-

-

If you want, enter a specific search value in the Enter a Value field.

-

Click OK.

Two AR adjustment reports appear in a separate window.-

AR Adjustment Register

-

AR Adjustment Register GL Summary

-

If you click Print Reports prior to posting, the message "Audit Not Posted" appears in the upper right corner of the report. You can review this report for accuracy prior to posting.

After posting, the audit number appears in the upper right corner of the report.

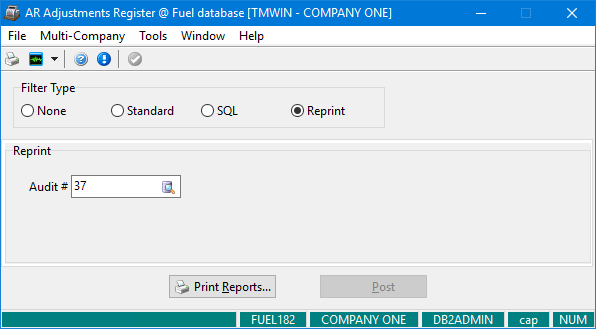

To reprint reports:

-

In the Filter Type section in AR Adjustments Register, select Reprint.

The AR Adjustments Register window redisplays as shown in this illustration.

-

Enter a valid audit number in the Audit # field or click

Pick List to search for and select an audit number.

Pick List to search for and select an audit number. -

Click Print Reports.

General Ledger entries made by AR Adjustments Register

The following postings are made according to the type of adjustment.

Adjustments that increase the invoice charge

A debit posting is made to the AR control account specified in the AR adjustment.

Credit postings are made to the account specified for the transaction code in AR Transaction Types, and to the accounts originally used for the tax postings (if applicable).

Adjustments that decrease the invoice charge

A credit posting is made to the AR control account specified in the AR adjustment.

Debit postings are made to the account specified for the transaction code in AR Transaction Types, and to the accounts originally used for the tax postings (if applicable).