Payroll and Returns Generator

The Payroll and Returns Generator program allows you to generate Payroll data and submit this information electronically (magnetic media filing) to Canadian and US tax agencies. The forms available are T4’s, 1099’s, W2’s, 940/941’s and RL1’s. You can also print hard copy payroll reports using this program.

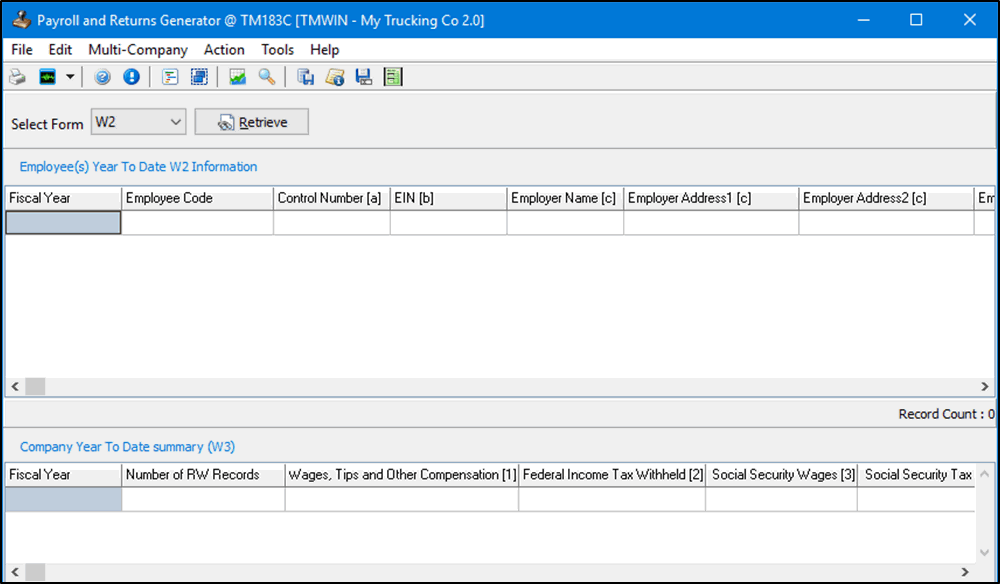

The main window allows you to retrieve payroll data based on selection criteria, review the data to see if the calculations for each employee and the company totals in the bottom grid are correct and address any erroneous data reported prior to rerunning the Retrieve function again or generating reports using this data.

Before you can generate data in the Payroll and Returns Generator program, you must first set up your company and employee records. These records are created in TruckMate’s Company Profiles program and Employee Profiles program.

| If you are experiencing errors in regards to the Date values in your system while using the Payroll and Returns Generator program, you may be able to fix the problem by changing your Windows Regional Date/Time settings. |

To access Payroll and Returns Generator:

| From this location | Go to |

|---|---|

TruckMate Menu and TruckMate Task List |

Accounting & Finance > Payroll > Payroll and Returns Generator |

Windows Start Menu |

TruckMate 20xx > Payroll and Returns Generator |

Windows Explorer |

C:\Program Files (x86) > TruckMate 20xx > MagMedia.exe |

Setting up Payroll and Returns Generator

Setting up Application Configurator for Payroll and Returns Generator

The following Application Configurator options are listed under Configuration Options > MAGMEDIA.EXE.

| Option | Definition | Value |

|---|---|---|

Calculate Box 18 on W2 By |

This option controls how 'Box 18' (Local Tax Wages) of the W2 IRS form is calculated by the Payroll and Returns Generator program. Linking means the Payroll and Returns Generator program will sum up the codes that have the checkboxes in Payroll Setup selected and linked to the W2 fields. Summing means the Payroll and Returns Generator program will issue a warning if a Local Tax with TAXABLE_WAGE_PORTION = 0 is found (this should not happen if the Record Taxable Wage Portion program was run to recalculate these missing values). Useful for US employees paying multiple local taxes. |

|

Generate SSA RS records |

Determines whether the Payroll and Returns Generator program will generate RS (State Wage Records) according to SSA (Social Security Administration) specifications. |

|

Grouped by SSN on W2 |

Determines whether the Payroll and Returns Generator program will group the records by SSN (Social Security Number) on the W2 form. |

|

Incl. voided Amounts |

Determines whether the Payroll and Returns Generator should include voided checks in the 'Get US Tax Liability and Recap' function. When set to 'False' (default), voided amounts will not be included in tax total calculations and/or the MagMedia submission data. When set to 'True' voided amounts will be included in an employee’s tax data. |

|