Test US Tax

| As of TruckMate 2020.3, the Test US Tax program is no longer available. |

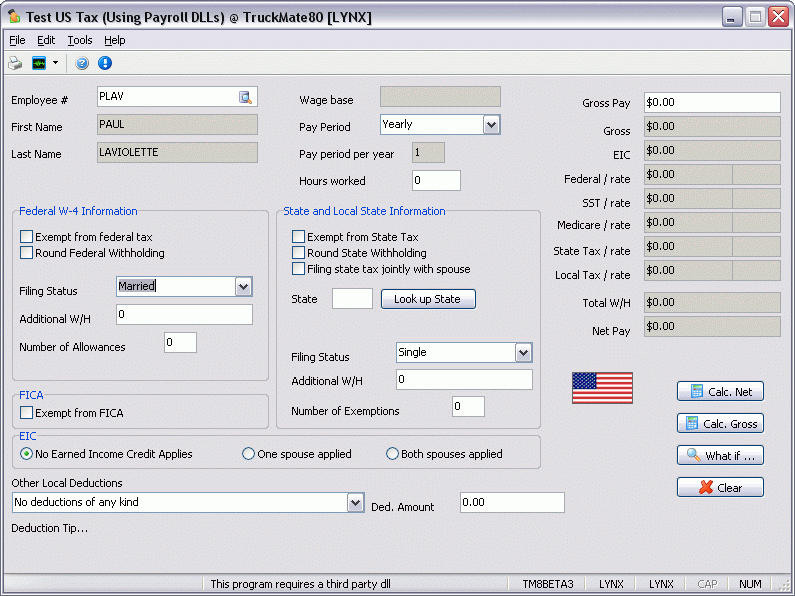

The Test US Tax Program allows an employer total control over the details of their employee taxation, from Federal down to Municipal government taxation levels. Working in concert with .DLL files provided by Symmetry Software, the Test US Tax program can produce tax breakdowns for any of your employees, based on all applicable tax profiles, and allows you to stay up to date with current taxation changes without any strenuous research.

To open the Test US Tax program in TruckMate versions 2020.2 and earlier, go to:

Start > Programs > TruckMate > Accounting & Finance > Payroll > Test US Tax

| While the Test US Tax program is available to all those who install TruckMate, it will not function without the Symmetry .DLL files, which TMW Systems provides for a subscription charge of $500 USD per annum. Once subscribed, TMW will provide you with the most recent build of the Symmetry .DLL’s, and will continue to update your system for as long as your company maintains its subscription. |

Menu Bar / Toolbar

File Menu

Print Reports

Selecting the Print Reports button will bring up the report selection window, common to many TruckMate applications. Here, you will select a report file from those available in your system and a Crystal Report will be generated.

Selecting the Print Reports button will bring up the report selection window, common to many TruckMate applications. Here, you will select a report file from those available in your system and a Crystal Report will be generated.

For more information on Report functionality in TruckMate, see the Crystal Reports Reference.

Exit

Closes the Test US Tax program.

Closes the Test US Tax program.

Multi-Company

For more information on the Multi-Company options available from the Menu Bar, see the Multi-Company documentation.

Tools Menu

TruckMate Monitor

Click the down arrow next to this button to access the various functions of the TruckMate Monitor.

Click the down arrow next to this button to access the various functions of the TruckMate Monitor.

Remember Position / Size

Selecting this option will rememeber the window position and size upon close. When you reopen the program, the window will appear the same.

Options

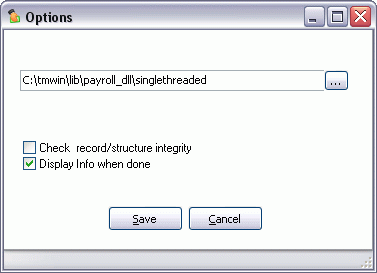

Click this menu item to open the Options window, which allows you to specify the location of the third party .DLL file used by this application.

See the Error Handling section for more information on the use of the Options window.

Help Menu

TruckMate Help

Selecting this button will open the Test US Tax topic in the TruckMate Online Help file (the page you are currently viewing).

Selecting this button will open the Test US Tax topic in the TruckMate Online Help file (the page you are currently viewing).

Service Portal

Selecting this button will open an instance of your default Internet browsing software, with the https://www.tmwcare.com login page displayed.

Selecting this button will open an instance of your default Internet browsing software, with the https://www.tmwcare.com login page displayed.

About

Selecting this button will open the standard TruckMate About window, which contains important information about the application you are currently using, including its version number (important for support calls).

Selecting this button will open the standard TruckMate About window, which contains important information about the application you are currently using, including its version number (important for support calls).

Header Information

Employee #

Click the search button to see a displayed list of your employees, based on the information provided in the Employee Profiles program.

Last Name / First Name

These read only fields will automatically populate when an employee is selected using the search menu.

Tax Taxable Year

Use the pull down menu to select a tax year.

| Selecting a previous taxation year for information purposes is allowed, but choosing any year beyond the current year will return an error message. |

Wage base

This read only field will automatically populate based on the employee selected.

Pay Period

Use the pull down menu to select the appropriate pay period for the selected individual.

Gross Pay

The 'Gross Pay' option allows you to manually enter an employee’s pay for a specific 'Pay period'. Notice that when the program is first started (as in the image above, the data in these fields is populated as zero values. When you enter a monetary value into the 'Gross Pay' text field and type your 'Enter' key, or click the 'Calc. Net' button below, all of the taxation rate fields will be populated with the accurate data, based on the .DLL supplied from Symmetry and the options you have selected within the 'Test US Tax' program main menu. Once initially populated, these values will change dynamically when the user alters the selected options. This functionality allows you to test how certain taxation laws will affect your employee.

The 'Total W/H' field displays the total amount of withholdings for the selected employee, for the selected 'Pay Period'. 'Net Pay' displays the actual take-home salary of the currently selected employee.

Federal W-4 Information

The Federal W-4 form is used by the IRS for taxation purposes and is mandatory for all American workers, unless they have applied for and received a specific exemption.

Exempt from federal tax

Check this option if your employee is exempted from Federal taxation.

Round Federal Withholding

When checked, this option will round off the value of Federal taxes for the selected employee. Any amount with 51 cents or over will be rounded up to the next dollar value.

Filing Status

Use the pull down menu to choose the appropriate 'Filing Status' for the selected employee. The options are: 'Single', 'Married', 'Head of Household' and 'Supplemental'.

Additional W/H

Use this text field to manually enter any additional and/or specific Federal withholdings for the selected employee.

Number of Allowances

Enter the number of allowances for the selected employee here.

State and Local State Information

This section handles taxation information for all 52 States.

Exempt from State Tax

Check this option if your employee is exempted from State level taxation.

Round State Withholding

When checked, this option will round off the value of State taxes for the selected employee. Any amount with $.51 cents or more will be rounded up to the next dollar value.

Filing state tax jointly with spouse

Select this option if the selected employee will be filing State taxes jointly with a spouse.

State

![]() Click this button to select a State code from a generated list.

Click this button to select a State code from a generated list.

Filing Status

Use the pull down menu to choose the appropriate 'Filing Status' for the selected employee. The options are: 'Single', 'Married', 'Head of Household' and 'Supplemental'.

Additional W/H

Use this text field to manually enter any additional and/or specific State withholdings for the selected employee.

Number of Exemptions

Enter in the number of exemptions that the selected employee currently has a claim to.

FICA

Exempt from FICA

Under the Federal Insurance Contributions Act (FICA), 12.4 percent of your earned income up to an annual limit must be paid into Social Security, and an additional 2.9 percent must be paid into Medicare. If the selected employee is exempt from FICA taxation, check the 'Exempt from FICA' option.

EIC

If your employee qualifies for the Earned Income Credit (EIC) in the United States, select either the 'One spouse applied' or 'Both spouses applied' options. If your employee doesn’t apply, leave the 'No Earned Income Credit Applies' option checked.

Program Buttons

Calc. Net

Selecting the 'Calc. Net' button will automatically calculate the Employee’s Net pay based on the settings entered in this program.

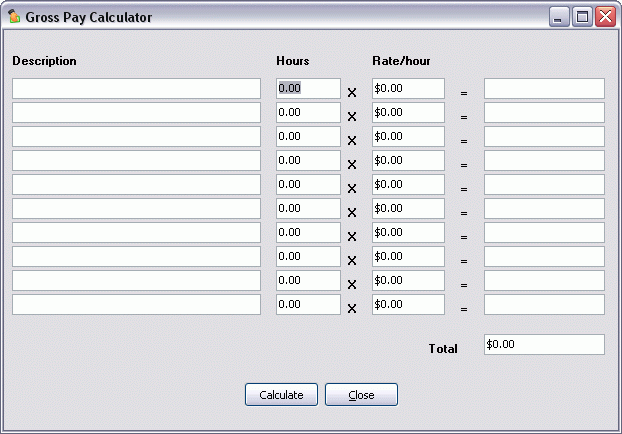

Calc. Gross

Selecting the 'Calc. Gross' button will bring up the Gross Pay Calculator window, where you can manually calculate the gross pay of the employee

Manually enter in all the values required, and when you are finished, click 'Calculate'. The total amounts will be displayed on the right hand side of the menu. If all the data is satisfactory, click 'Close' and the entered values will be populated in the 'Gross Pay' section of the program’s main menu.

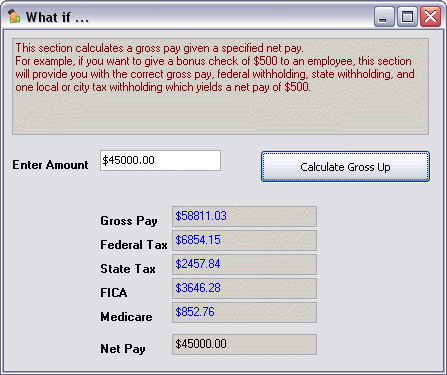

What if…

Selecting the 'What if…' button will open the What if… window, where you can determine an employee’s 'Gross Pay' given a specific 'Net Pay' value.

Enter an amount that you want to become the employee’s 'Net Pay' and click on the 'Calculate Gross Up' button. The window will then expand down to reveal the details of the calculation. In the above example, if the employee will receive $1,500 USD 'Net Pay', you must actually pay out $2,479.70 USD, based on the specific taxation profile.

Clear

Selecting the 'Clear' button clears all information from the 'Gross Pay' menu and the 'Wage base' field.

Error Handling

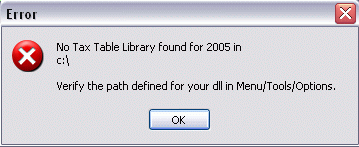

When run for the first time, the Test US Tax program will return an Error message.

This error will occur even if you have already purchased your subscription. If you do not have a subscription and wish to use the Test US Tax program, contact TMW Support. If you have purchased your subscription and have the necessary .DLL files, follow these steps:

-

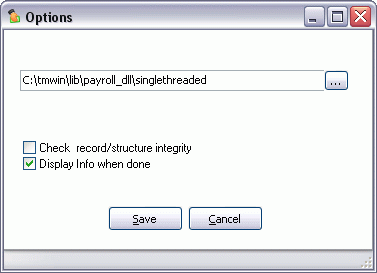

Open the 'Tools' menu and click 'Options'. The Options window will appear.

-

Click the search button and select the location of your .DLL file. It will not necessarily match the path displayed here.

-

When you have located the .DLL, you may select from the available options, or click 'Save' to begin using Test US Tax.

Check record/structure integrity

This option will scan the .DLL file you have chosen for integrity, and will return an error message if there are any problems.

Display Info when done

When checked in conjunction with the 'Check record/structure integrity' option, this will display to your screen the details of the .DLL integrity inspection.