Detailed Functions

Adjust Probill

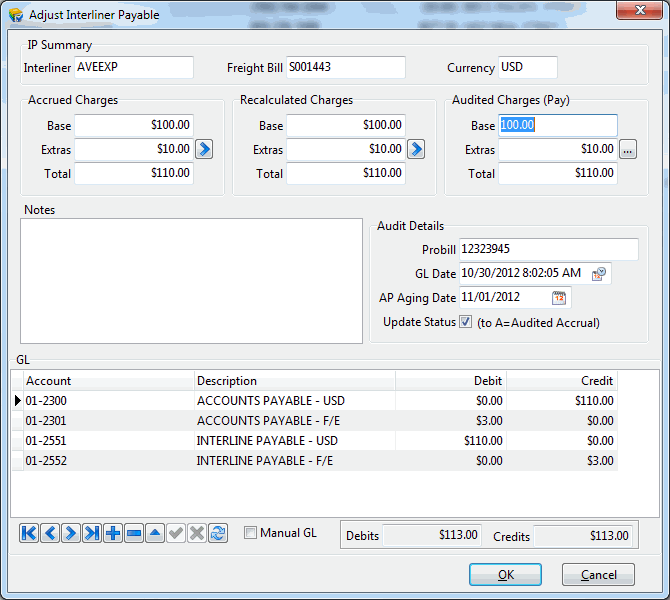

The Adjust Interliner Payable window is for making adjustments to interline transactions as part of auditing these transactions. The window is accessible either from Interliner Details grid > using the right mouse button (right click) > Status Change > Audit and Adjust Accrued, or via Ctrl-J short cut key. An additional way to access this window is by double-clicking one of the following fields: Vendor’s Probill, GL Date, Adjusted Sub Total, Adjusted Extras, or Adjusted Total.

| The Update Status option is checked by default if the Adjust Interliner Payable window is called via Ctrl-J or context menu. When the Adjust Interliner Payable window is accessed via the eligible columns, the Update Status option is unselected. Double-clicking via eligible columns allows you to change editable fields if you are not ready to audit the record. Once a field is changed, manually selecting the Update Status option causes the AP Aging Date and Adjusted Amounts to update properly. |

IP Summary

This section displays basic information about the adjusted probill. Information like the interliner code, the freight bill number and the used currency are displayed in this section.

Accrual Charges

This section displays the accrued (actual) charges for the selected interlier on the selected freight bill.

Base

The accrued base charges. Can be edited by the user.

Extras

This field displays the accrued extra charges (accessorial charges) for the interliner.

Total

Will display the sum of the Base and the Extras fields.

Recalculated Charges

This section displays the recalculated amounts of the interline pay record. All available fields in this section are read-only. The 'Recalculated Charges' are calculated on-the-fly when you open the form, using current FB info. A difference between the value of the 'Accrual Charges' and the value of the 'Recalculated Charges' is only present if values affecting the IP charges on the Freight Bill are changed after posting the IP record.

Base

This field displays the recalculated base charges.

Extras

This field displays the recalculated extra charges (accessorial charges) for the interliner.

Total

Will display the sum of the Base and the Extras fields.

Audited Charges

This section displays the audited amounts of the interline pay record.

If the values in this section are zeros, and 'Adjusted Interline Payable' form is brought up via CTRL + J short cut key, and only if brought up in this way, not by double clicking columns in the main form, the values in this section are copied over from either the 'Accrual Charges' section or the 'Recalculated Charges' section. In a normal scenario, the values in both sections will be the same. However, If there is a difference between the 'Accrual Charges' and the 'Recalculated Charges', you can select which charges (set of values) to be used (copied over to) the 'Audited Charges'. You can simply select the blue arrow visible in either the 'Accrual Charges' section or in the 'Recalculated Charges' section to copy the values of that section over to the 'Audited Values' section. If neither of the blue arrows was selected, the charges that are set to be the default charges will be used. The default charges are set using an application configuration option 'Default Audited Charges' in Application Configurator program > Interline Payable > IPIIPM.EXE.

| Remember that the above mentioned scenario only happens once, when the values in the 'Audited Charges' section are 'Zeros', and the form is accessed via CTRL + J, not by double clicking on the column in the main form. |

Base

This field displays the audited base charges.

Extras

This field displays the audited extra charges (accessorial charges) for the interliner. Using the ellipse button, you can view (and possibly adjust) the individual vendor accessorial / extra charges attached to the IP record. In the grid that comes up, on clicking the ellipse button, there is a (read-only) column titled "Recalculated", which holds the dollar amount of the individual recalculated accessorial charge.

Total

Will display the sum of the Base and the Extras fields.

Notes

The Notes field is used to specify a reason for the adjustment, or add any relevant information related to the adjustment transaction.

Audited Details

Probill

Enter the interline’s probill number in this field, if it was not already entered in the Customer Service program or Quick Bill Entry program. You must enter an interline Probill before you can set the transaction to the Audited status.

GL Date

This field will be used as the date of the GL posting between interline payable and accounts payable, and if the amount being posted is different from the accrual amount, this date will also be used for the IP expense transaction created as a result of this difference. In addition, this date is also going to be assigned to the 'GL Date' field in the created 'AP Bill'.

AP Aging Date

This field is the date when the accounts payable transaction would be considered as aging (past due). This date allows you to specify when an interliner should be paid, while at the same time specify a different date for the GL transaction ('GL Date'), allowing you to put the expense interline adjustment transaction (if any) in the same GL period of the corresponding FB revenue, and specify a different independent date to make the payment to the interliner.

Update Status

This flag is a way to instruct the system whether to change the status to 'A' (Audited) or not when you make changes to other fields in the 'Adjusted Details' section. If you uncheck this checkbox, the status will not change as a result of editing the fields in this section. This can be useful when you get more accurate information but are not ready to audit the record yet (haven’t received the interliner’s invoice yet).

This field is checked by default if the window is called via Ctrl-J or the context menu option, and is unchecked by default if called via double-click on one of the following eligible fields.

-

Vendor’s Probill

-

Adjusted Sub Total

-

Adjusted Extras

-

Adjusted Total

-

GL Date

GL

This section displays and can be used to edit GL transactions associated with the interline audit transaction. The grid displays the GL transactions, a checkbox at the bottom of the grid 'Manual GL' can be checked to allow you to edit the GL entries. Editing of GL is governed by the following requirements:

-

Total debit must equal total credit.

-

Total amount posted to IP Payable accounts must exactly match the Accrued Total Charges.

-

The posted transactions to the IP payable account(s) must exactly match the accrual transactions posted to the same account(s) for the selected IP record.

-

Total amount posted to AP payable accounts must exactly match the Adjusted Total Charges.

If any of the above listed requirements is broken by your manual GL entry, an error will popup on selecting the 'OK' button.

If any other method is used to audit an IP record (eg. 'Audit Accrued' or Quick Audit'), then the GL is still generated, you just don’t get to review it or make manual changes to it.

Trip/Manifest

Adjusted Base

This is a read-only field that displays the adjusted 'base' payment to the Interliner.

Extras

This is a read-only field that displays the adjusted Accessorial Charge paid to the Interliner.

Adjusted Total

Will display the sum of the Adjusted Base and the Adjusted Extras fields.

Interline Probill

Enter the interline’s probill number in this field. You must enter an interline Probill before you can set the transaction to the Audited status.

Remit Date

Use the calendar selection menu to choose a Remit Date. The Remit Date is the date that will be updated in the 'AP_SUM' and 'AP_BILL' tables as the 'TX_DATE' value (transaction date).