System Integrity Checker

The System Integrity Checker (SIC) program is a series of complex routines that analyze the integrity of your system. Checking such as basic set up issues, subsidiary ledgers balancing to G/L control accounts, to much more integrate issues involving dispatch can be run as deemed necessary by your system administrator or TMW Systems personnel.

SIC is currently available for the Accounts Receivable, Accounts Payable, Driver Payables, Rating, and Dispatching Modules. The General Ledger system is also checked as a by-product of the above routines.

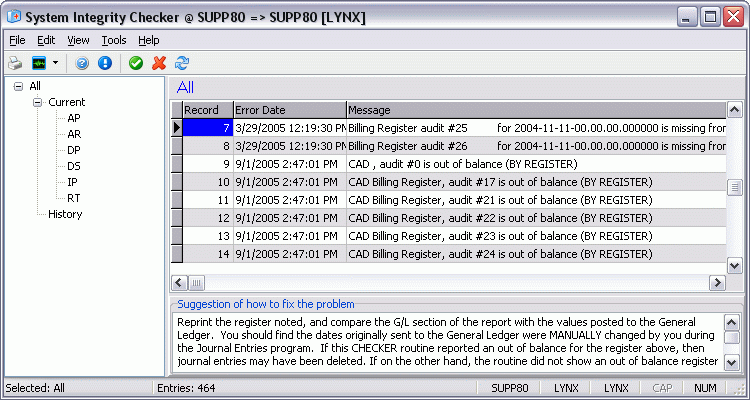

The System Integrity Checker program window is divided into three sections: the left side 'Tree' menu for browsing the available Integrity checks for the supported programs, the main 'Error Handling' window, and the 'Suggestion' window at the bottom, which details a possible solution to the selected Error message in the 'Error Handling' window.

The routines provide advanced analysis and reporting, and in very limited situations, will attempt to correct problem situations. Each of the routines is explained in detail below. The areas where SIC actually corrects problems are identified in BOLD. Rerunning the report a second time should naturally not report these errors a second time, as they would be corrected the first time through. Warning or cautions are simply reported for informational purposes. Suggestions are given as to what the problem may be, and where to look for possible solutions.

Do not be concerned about a large number of reported errors and warnings. Certain actions like deleting opening balances that are posted to the G/L will cause numerous errors to be reported. This may be a perfectly normal implementation step, however SIC cannot differentiate between a planned deletion and an accidental deletion. Other areas like manually posting journal entries to a G/L control account will be identified as a warning… as this should be avoided wherever possible.

Again, the first time you run these routines, you may be alarmed at the number of errors reported. Review the report and make corrections to items that are deemed "actual" setup or balancing errors. Once these have been corrected, run the report every couple of weeks to verify NO NEW errors have been reported. These SIC routines will allow you to verify you have the integrity of the TruckMate system under control.

To activate this routine you will need to load the 'SYSTEM INTEGRITY CHECKER.RPT' report, running this from the Crystal Report Launcher. Select the modules you would like to analyze, and then run the report. You can run this report at any time, regardless of who is on the system or what they are doing. It will 'work' the system for a few minutes, but should not sap out all your server resources. If you are concerned about this, run the report in off hours until you feel more comfortable with its behavior.

To access System Integrity Checker:

| From this location | Go to |

|---|---|

TruckMate Menu and TruckMate Task List |

Utilities > System Integrity Checker |

Windows Start Menu |

TruckMate 20xx > System Integrity Checker |

Windows Explorer |

C:\Program Files (x86) > TruckMate 20xx > Syschecker.exe |

Menu options

This topic describes menu and toolbar options and functionality that are specific to the System Integrity Checker window.

For information about common menu and toolbar options (i.e. File menu, Refresh, Multi-Company, etc.), see General menu and toolbar options in TruckMate Basics.

Running the System Integrity Checker

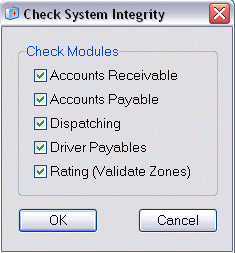

![]() Click this button to begin your System Integrity Check. The Check System Integrity window will be displayed, prompting you to choose which applications you would like to check for Integrity Errors.

Click this button to begin your System Integrity Check. The Check System Integrity window will be displayed, prompting you to choose which applications you would like to check for Integrity Errors.

Simply clear the checkboxes of the applications you want to exclude from the Integrity Checking process. Click OK, to start the integrity checking process.

The amount of time the System Integrity Check process will take depends on the size of the database being queried. If your database contains a high volume of data, the process could take hours.

System Integrity Checker module-specific procedures

Accounts Payables

-

Remove all previous errors reported so this routine reports existing errors only.

-

Determines how many different CURRENCY CODES you are using within Accounts Payable, and then confirms you have ONE, and only ONE Accounts Payable Control account set up in the G/L for each currency. Errors are reported for TOO MANY, or MISSING accounts.

-

Verifies each Check Register and AP Invoice Register entry has correct and offsetting G/L entries for the correct control account, based on currency above.

-

Verifies each of the proper G/L entries were made for each DATE. Item 3 above may prove a register is correct, but this item would confirm that the dates of the G/L transactions were NOT changed before actually posted to the General Ledger.

-

Checks the G/L Control accounts for manually entered G/L transactions. Although you may know why you did these, in practice, only TruckMate should post to control accounts. If you are changing the dates, performing accruals, etc., then you will have a warning reported for both the in and the out of each of these transactions. As long as you know these are correct, you can ignore the warnings.

-

Checks to see if somehow a transaction exists for a vendor that no longer exists. This could only happen if someone were to delete a vendor through a non-TruckMate program. In this case, a vendor master record is recreated so the transactions will automatically reappear.

Accounts Receivables

-

Remove all previous errors reported so this routine reports existing errors only.

-

Verifies that no G/L Control Accounts have been used as offsets to the A/R Adjustments Code you have set up. Normally a Revenue or Expense account would be referenced. Affecting a Liability or Asset account is not normal. Using a Control Account is NOT ALLOWED and will be reported as an error.

-

Determines how many different CURRENCY CODES you are using within Accounts Receivable, and then confirms you have ONE, and only ONE Accounts Receivable Control account set up in the G/L for each currency. Errors are reported for TOO MANY, or MISSING accounts.

-

Verifies each Billing Register, Adjustment Register and Cash Receipt Register entry has correct and offsetting G/L entries for the correct control account, based on currency above.

-

Verifies each of the proper G/L entries were made for each DATE. Item 4 above may prove a register is correct, but this item would confirm that the dates of the G/L transactions were NOT changed before actually posted to the General Ledger.

-

Checks the G/L Control accounts for manually entered G/L transactions. Although you may know why you did these, in practice, only TruckMate should post to control accounts. If you are changing the dates, performing accruals, etc., then you will have a warning reported for both the in and the out of each of these transactions. As long as you know these are correct, you can ignore the warnings.

-

Verifies the TOTAL OWING for each client is correct, and if adjustment is required, automatically updates the client balance with the newly calculated total.

-

Checks to see if somehow a transaction exists for a customer that no longer exists. This could only happen if someone were to delete a customer through a non-TruckMate program. In this case, a customer master record is recreated so the transactions will automatically reappear.

-

Verifies each of the ZONE CODES set up in the CLIENT PROFILE is still valid. Also checks for customers MISSING ZONE CODES altogether.

Dispatch

-

Remove all previous errors reported so this routine reports existing errors only.

-

If NO ERRORS are found in this routine, ALL OKAY MESSAGES will be shown. This is the only routine that reports an ALL OKAY.

-

Checks your STATUS CODES, and verifies you have at least ONE DEFAULT status code for each of the status behaviors.

-

The ITRIPTRA (Trailers), ITRIPPUN (Power Units), ITRIPDRI (Drivers), and ITRIPEQU (Misc. Equipment) tables should only contain records for ACTIVE or PLANNED resource assignments. If a resource is AVAILABLE, and not planned on a subsequent trip, no record should exist in this table. If found, the record is automatically removed from this table.

-

If a resource as in item 4 is not on a trip, check to assure the CURRENT TRIP record in the PROFILE is set to zero. If non-zero, this routine will correctly reset the value to zero.

-

Freight bills on a trip are recorded in the Intersection table called ITRIPTLO. When a freight bill is no longer active on a trip, the record in this table is changed to CURRENTLY_ASSIGNED = `False'. This routine checks for freight bills still CURRENTLY_ASSIGNED = `True' where the trip is actually completed (not active). This routine will complete the freight bill, log an entry in the ODRSTAT (status change) as corrected by this routine, and change the ITRIPTLO table to CURRENTLY_ASSIGNED = `False'.

-

Verifies all G/L control accounts for Interliner Payables were correctly assigned older freight bills. If entries are missing, each freight bill will be automatically updated to reflect the I/P Control Account.

Driver Payables

-

Remove all previous errors reported so this routine reports existing errors only.

-

Determines how many different CURRENCY CODES you are using within Driver Pay, and then confirms you have ONE, and only ONE Driver Payables Control account set up in the G/L for each currency. Errors are reported for TOO MANY, or MISSING accounts.

-

Verifies each Driver Deduction and Driver Pay Register entry has correct and offsetting G/L entries for the correct control account, based on currency above.

-

Verifies each of the proper G/L entries were made for each DATE. Item 3 above may prove a register is correct, but this item would confirm that the dates of the G/L transactions were NOT changed before actually posted to the General Ledger.

-

Checks the G/L Control accounts for manually entered G/L transactions. Even though you may know why you did these, only TruckMate should post to control accounts. If you are changing the dates, performing accruals, etc., then you will have a warning reported for both the in and the out of each of these transactions. As long as you know these are correct, you can ignore the warnings.

-

Driver’s balances are checked against the posted transactions (trip pay less deductions), and posted back to the driver master if found to be incorrect.

-

Checks to see if somehow a transaction exists for a driver that no longer exists. This could only happen if someone were to delete a driver through a non-TruckMate program. In this case, a driver master record is recreated so the transactions will automatically reappear.

Rating (Validate Zones)

| Do not run this routine unless you are using the Rating module fully. The routine can generate hundreds of pages of warnings for Zone Codes that are never referenced in a Rate Table, and other similar checks. If you are just dabbling in Rating, you should bypass this test._ |

-

Remove all previous errors reported so this routine reports existing errors only.

-

Attempts to see that every zone in your system could have a rate associated with it. This routine checks the rating for the 'To Zone' Code, and if not referenced, the parent zone, and if not referenced, inclusion within a range of Rate Base Numbers, and if not referenced, finally check the 'From Zone' Code. If not referenced in any of these, a warning message is generated.

-

Verifies the RATE BASE ZONE CODE referenced actually exists in the ZONE TABLE. Problems are identified.

-

Verifies all the ZONE CODES referenced in RATE TABLES do in fact exist in the ZONE TABLE.