Payroll Configuration

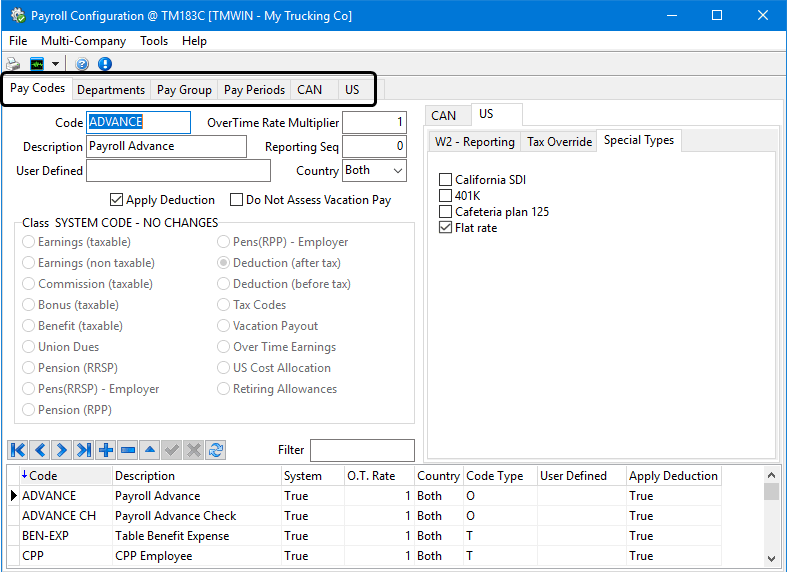

The Payroll Configuration program is used to configure the codes and rates used in the Payroll system. This information is grouped into several tabs.

-

The Pay Codes tab is where you define those codes used to represent the type of transaction associated with the line items in your time sheets and also the stub details in your paychecks. Sub-tabs allow you to map the pay (or deduction code) to a specific box in your tax return forms. This allows you the flexibility to assign all transactions belonging to a specific pay (or deductions) code to the calculations for a given box on your tax returns.

-

The Departments tab is where you define the various pay group divisions for your employees. Department codes allow you to set default payroll expense accounts to groups of employees.

-

The Pay Group tab is where you can define one or more groups of employees to process pay for in batches.

-

Departments and pay groups can be used together to precisely control how payroll expenses are assigned and processed each payroll period.

-

The Pay Periods tab is used to define the different pay periods you use to pay your employees. These period definitions are important because they are used to calculate the portions of your tax deductions that should be taken each pay period.

-

The CAN tab is used to define rates for Canadian payroll regarding: TD1 (basic tax credit) , employment insurance deduction rates, and workers compensation deductions.

-

The US tab is used to define information for US Payroll in these areas: SST, Medicare, Unemployment (FUTA and SUTA - federal and state unemployment tax systems) rates, Tax Tables Federal and State, Local Tax Tables, Cost Allocation Tables, and links to the Synergize Payroll (dll) integration.

|

The Payroll Configuration program will allow you to define any two character combination to use as the designated SUTA state code in the US > Unemployment tab. While the program does not force you to enter standard two character state codes, any returns generated using the TruckMate Payroll and Returns Generator (MagMedia.exe) with invalid codes will be rejected by the IRS. Because of this, you must reset your state codes to the actual correct two character state code, in caps (i.e., AL, WA, OR). Once you have changed these codes, you must also ensure the corrected codes are updated in the Employee Profiles program on the US Tax > FUTA/SUTA tab. |

|

RPP Pay Code type Canadian companies that have non-RRSP, RPP (Registered Pension Plan) deductions can set up a new code for RPP deductions in the Payroll Configuration > CAN > Tax Credit (TD1) tab. |

To access Payroll Configuration:

| From this location | Go to |

|---|---|

TruckMate Menu and TruckMate Task List |

|

Windows Start Menu |

TruckMate 20xx > Payroll Configuration |

Windows Explorer |

C:\Program Files (x86) > TruckMate 20xx > PRConfig.exe |

Setting up Payroll Configuration

Setting up Application Configurator for Payroll Configuration

The following Application Configurator options are listed under Configuration Options > PRCONFIG.EXE.

| Option | Definition | Value |

|---|---|---|

Allow Same Letter In Box 12 For Different Pay Code |

Controls whether you can assign the same letter code more than once in 'Box 12' of the W2 IRS form for different pay codes. |

|

Driver Pay Transfer |

Determines whether the deductions will go directly to A/P. If 'False', it allows all non-taxable earnings (e.g., Driver advances) and deductions to be sent directly to the payroll system, and factored into the Driver’s net check. |

|

Vacation Pay Default |

Determines whether vacation pay will accrue on vacation payout. If 'False', vacation pay will not accrue on the amounts paid out to employees as vacation pay. |

|