Stock Adjustments Register

The Stock Adjustments Register program is used to update inventory entries made to the Stock Adjustments Program. Enter the inventory information into the R&M Inventory Adjustments Program and then open and process the entry in the R&M Inventory Adjustments Register program. These entries are then available for updating through the General Ledger Journal Entries Register program.

To access the Stock Adjustments Register program:

| From this location | Go to |

|---|---|

TruckMate Menu and TruckMate Task List |

Repair & Maintenance > Stock Adjustments Register |

Windows Start Menu |

TruckMate 20xx > Stock Adjustments Register |

Windows Explorer |

C:\Program Files (x86) > TruckMate 20xx > RMInvAdjReg.exe |

How Do I?

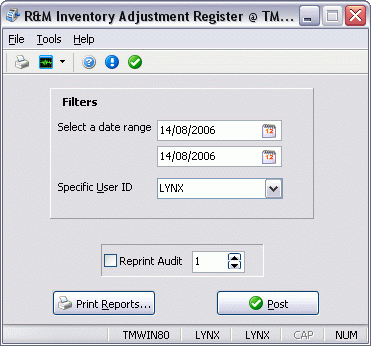

How do I Post Stock Inventory Entries?

The Stock Adjustments Register program is used to update inventory entries made to the Stock Adjustments program. Enter the inventory information into the Stock Adjustments program and then open and process the entry in the R&M Stocks Adjustment Register program. These entries are then available for updating through the General Ledger Journal Entries Register program.

-

Open the Stock Adjustments Register program.

-

Select the 'Date Range' you want to update.

-

Select a specific 'User ID', if applicable.

-

Select the 'Report' button to review the register. If, after reviewing the report, the information is accurate, select 'Post' to update.

-

To reprint a past register place a checkmark in the 'Reprint Audit' field and select 'Report' to review the information requested.

Menu and toolbar options

This topic describes menu and toolbar options and functionality that are specific to the R&M Work Order Register window.

For information about common menu and toolbar options (i.e. File menu, Refresh, Multi-Company, etc.), see General menu and toolbar options.

Tools Menu

Post

![]() Will generate a report identical to the one created with the inclusion of the audit numbers, using the Report function. General ledger postings will be created for the included entries. These general ledger postings can be viewed using the GL Journal Entries program. Until the entries are updated using the GL Journal Entries Register program, they will not be included in the GL Chart of Accounts balances.

Will generate a report identical to the one created with the inclusion of the audit numbers, using the Report function. General ledger postings will be created for the included entries. These general ledger postings can be viewed using the GL Journal Entries program. Until the entries are updated using the GL Journal Entries Register program, they will not be included in the GL Chart of Accounts balances.

Filters

Date Range

You can post stock adjustment information based on a range of dates. The dates specified here correspond to the Stock Adjustment date associated with the stock adjustment entry. Click on the button to the right of the date fields for a calendar selection form.

Specific User ID

You can select adjustments for posting based on the user who entered the adjustment in the Stock Adjustments program. Select a user name from the drop down list box. You can view the user who entered the adjustment in the Stock Adjustment program, in the Entered By column. User names are configured in the Security Configuration program.

Reprint Audit

To re-print a stock adjustment register that had been previously updated, check the Reprint Audit box and enter the audit number in the field to the right. Audit numbers print on the register in the top right corner.

Report and Post

Print Reports

Will create a report that shows the included adjustment items and the general ledger distribution. You can use this report to confirm that your selection criteria are correct. The Report function does not update the status of the adjustment entry or create postings in the general ledger module; nor does it generate an audit number. It is used only for reporting purposes. The report will be previewed to the screen. To send it to a printer, click the printer icon at the top.

For more information on Report functionality in TruckMate, see the Crystal Reports Reference.

Post

Will generate a report identical to the one created with the inclusion of the audit numbers, using the Report function. General ledger postings will be created for the included entries. These general ledger postings can be viewed using the GL Journal Entries program. Until the entries are updated using the GL Journal Entries Register program, they will not be included in the GL Chart of Accounts balances.