Fuel Management Module

FT.RPT

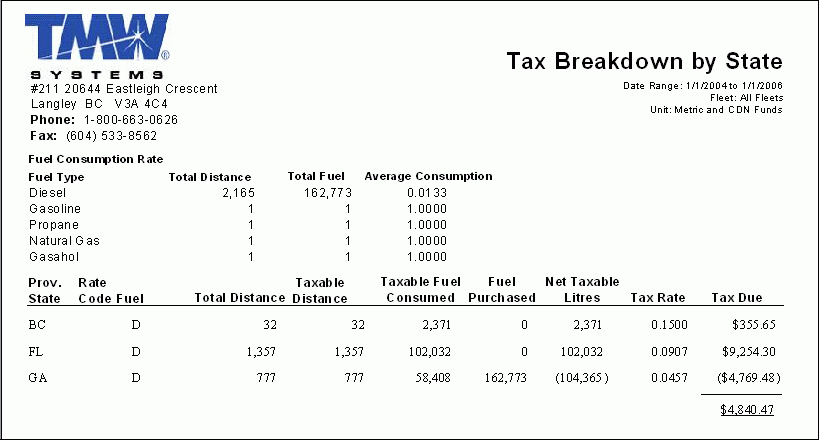

The Tax Breakdown by State report is the most important report in the Fuel Tax system, and is accessible from the Fuel Tax Trip program (TRIP.EXE). This report is where you’ll get information needed for your IFTA tax reporting. In addition, this report provides an excellent way to get a breakdown of Fuel Taxes (and Total Mileage/Fuel) by 'State/Province' for each Power Unit in your system with totals. It is advisable to print this report on a monthly basis. This is also a useful report if you wan to give the Owner/Operators a report showing their tax share for a certain period.

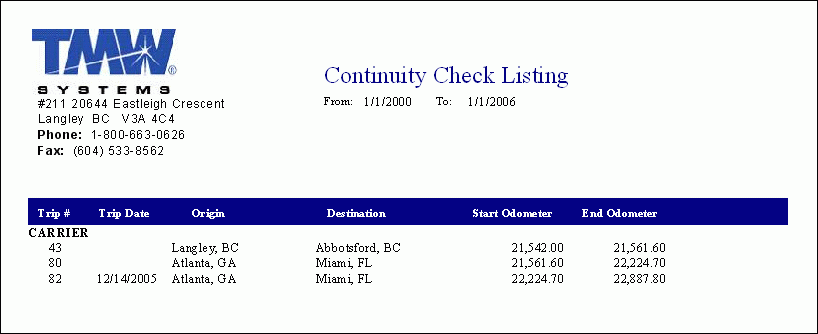

FTCONT.RPT

This report will flag any missing or overlapping mileage. Request the report from end-date of your previous report to the last-date of data entry, and fix any issues that occur when running this report. The Continuity Report is broken down by power unit, and should be run on a monthly basis, prior to gathering and sending IFTA data. This report is accessible from the Fuel Tax Trip program (TRIP.EXE).

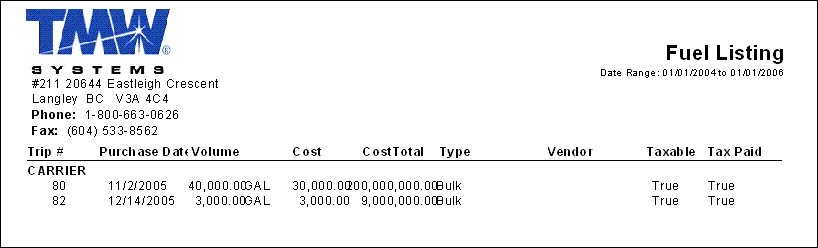

FTFUEL.RPT

This report will print out a fuel listing containing all information regarding fuel purchases specific to your parameters. This report is accessible from the Fuel Tax Trip program (TRIP.EXE).

When the report is run, it will ask for you to provide a Date Range to filter the fuel purchases: enter a 'Starting' and 'Ending' Date to constitute the Date Range, and the fuel records that fall within the range will be displayed in the report.

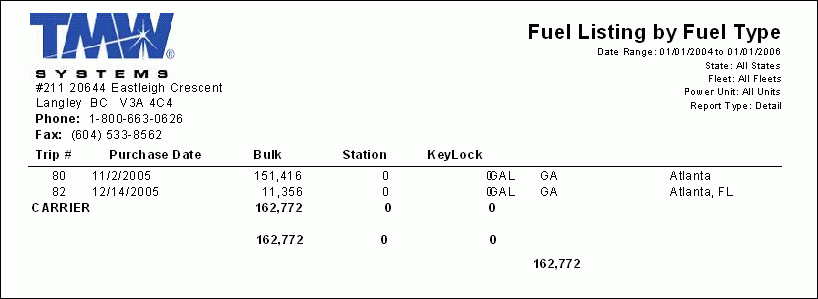

FTFUELTYPE.RPT

This report will print out a listing of fuel types purchased. For example, whether the fuel was bought in bulk, cardlock (keylock), or service stations. This report is accessible from the Fuel Tax Trip program (TRIP.EXE).

When the report is run, you will have to provide the following information:

-

Enter a 'Starting' and 'Ending' Date to constitute the Date Range, and the fuel records that fall within the range will be displayed in the report.

-

The choice to 'Print Totals in Gallons/US$' or not.

Select a two-digit 'State Code' to filter the fuel purchases by the State/Province they were purchased in, or select the '*' option to include ALL States/Provinces.

Filter on a specific 'Fleet Code' by selecting the search button and entering a 'Fleet ID' in the field provided. Fleet ID Codes are maintained in the Fleet Profiles program. Select the '*' option to include ALL Fleet Codes.

If you would like to print a 'Summary Report', select 'True' in the drop-down menu provided. If you select 'False', a 'Detailed' report is produced. The 'Summary' report omits 'Trip #' and 'Purchase Date' information.

Filter on a specific 'Power Unit Code' by selecting the search button and entering a 'Power Unit ID' in the field provided. Power Unit Codes are maintained in the Power Unit Profiles program. Select the '*' option to include ALL Fleet Codes.

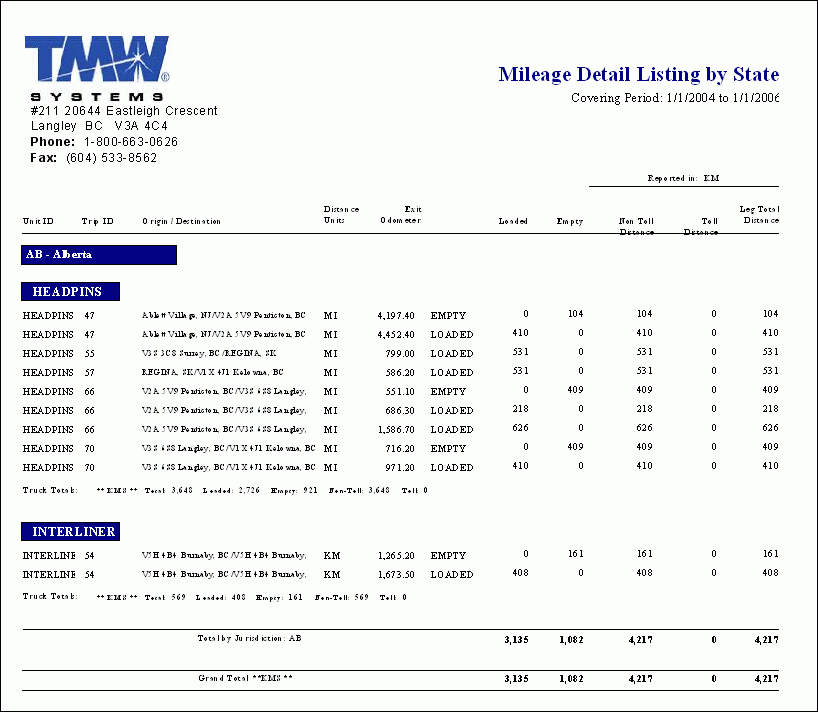

FTMI.RPT

The 'FTMI.RPT' produces a Mileage Listing by State/Province report, that will show you your mileage over a Date Range, broken down by State/Province. Run this report if you are trying to narrow down any Mileage entry issues. This report is accessible from the Fuel Tax Trip program (TRIP.EXE).

When the report is run, you will have to provide the following information:

-

Choose to display the mileage information in either 'KM - Kilometers' or 'MI - Miles'.

-

Enter a 'Starting' and 'Ending' Date to constitute the Date Range, and the fuel records that fall within the range will be displayed in the report.

-

Select the 'Jurisdiction' Codes you would like to include in the report. Select a Jurisdiciton (State/Province) Code in the left side window, then click the 'Add' button ('>') to move it to the 'Selected Values' window. You can 'Select All' values by clicking the 'Add All' button ('>>').

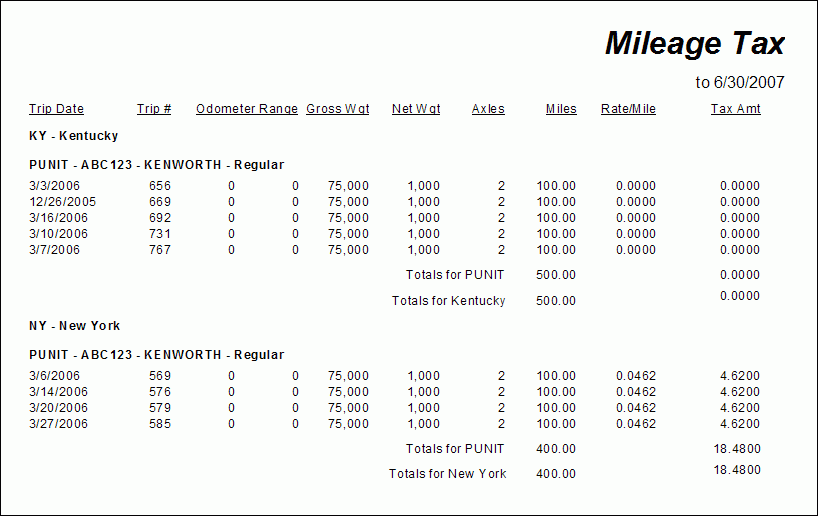

FTMILEAGETAX.RPT

This report will print out a listing of fuel Mileage Taxes. This report is accessible from the Fuel Tax Trip program (TRIP.EXE). When the report is run you must choose between the following parameters:

-

Jurisdiction*: select one of the following: 'KY - Kentucky', 'NM - New Mexico', 'NY - New York' or 'OR - Oregon'. You can select any combination of the 4 applicable Jurisdictions (you can run them separately or all 4 in a single report).

-

Date Range*: this applies to activity date.

-

Summary / Detail*: 'Detail' prints a line for every single applicable FT_TRIP_DETAIL row (includes 'date', 'weights', 'axles', 'odometer', etc., as well as rate); 'Summary' only prints a line for each State/Punit combo and only prints Punit info and total tax amount for that State/Punit (cannot show rate because this could vary).

Note: The report is also filtered on TAXABLE=True

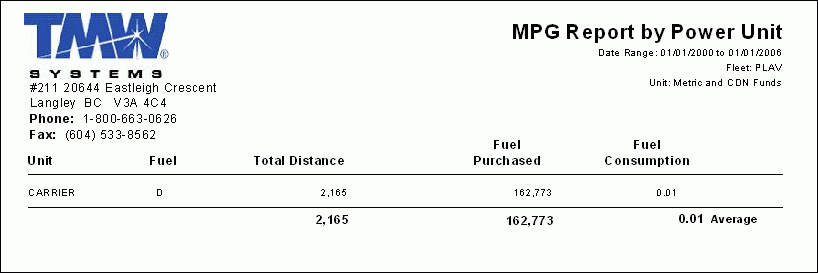

FTMPG.RPT

This report will print out a listing of the Miles per Gallon. For example, it would calculate how many miles you’re getting per gallon. For tracking and statistic purposes. This report is accessible from the Fuel Tax Trip program (TRIP.EXE).

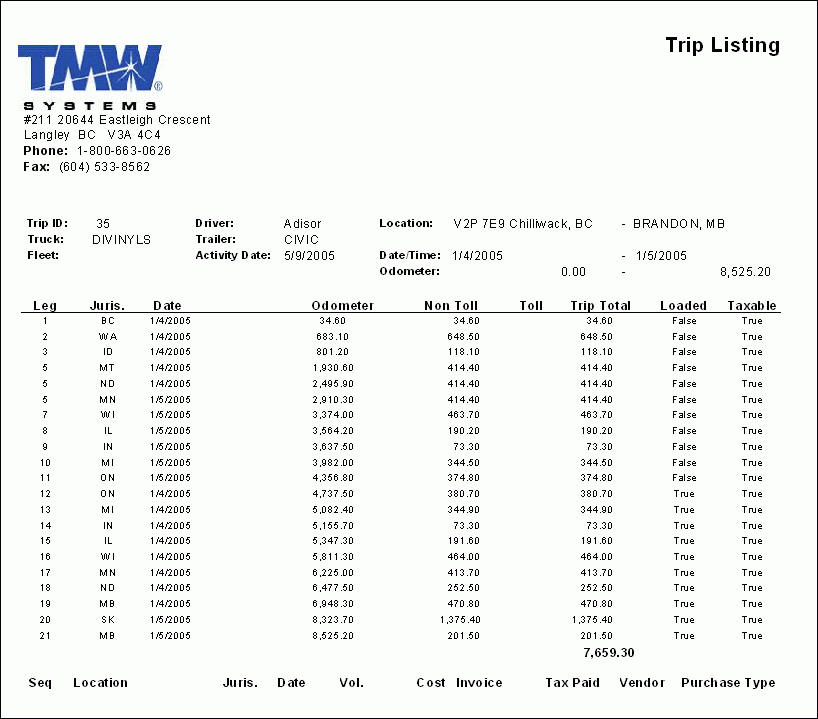

FTTRIP.RPT

This report will print out a detailed report by Trip of distance traveled, and fuel purchased. This report is accessible from the Fuel Tax Trip program (TRIP.EXE). When the report runs, you must provide a 'Trip #' to filter the report on.

Note: The 'Trip #' field is not a normal Dispatch 'Trip' number- the report requires that you enter a 'Fuel Tax Trip' number, which you can find by looking in the Fuel Tax Trip program’s 'Trip ID' field.